Six steps to writing research questions that get the best results

Eureka! You’ve got an idea for a business, product, service, or new functionality, a solution to a problem, or a hypothesis about why something is happening. Unfortunately, it’s a fact that not all ideas and solutions are good, and not all hypotheses are right. It’s a shame, but there it is. Before investing significant time and money, you’ll want to get a better idea if you’re on the right track. This is where primary research comes in.

There is a lot to consider when conducting market research, far too many elements for one blog post. However, writing great research questions will go a long way to getting the answers you need to move forward. There are lots of market research methods but we’ll focus on writing great questions for an online survey, where the questions have to work their hardest.

Step 1: Start with why and who?

It might be tempting to start writing questions off the top of your head. Hold fire! Before doing anything else it’s necessary to:

- Outline the problem

- Define the research objective

- Determine your target audience

Write them down and keep referring back to them. This will help you frame your questions to ensure your research achieves the objective. Respondents may not be able to give you a definitive answer to the problem you’ve identified, but collectively their input will help you draw conclusions and uncover patterns in their responses.

Carefully consider your target audience for the research. To test the idea efficiently, you should be focused on your target audience selection, even if your product or service may have a very broad appeal.

Think about talking to your core target. They might be existing customers; prospective customers; heavy category users; or even category non-users. Use demographics and also purchase and usage criteria to hone them down.

Step 2: Brainstorm questions

Spend some time scoping out what you already know. Challenge yourself to separate what you really ‘know’ from what you believe to be true. How do you know? Do you have data or previous research results you feel confident are accurate?

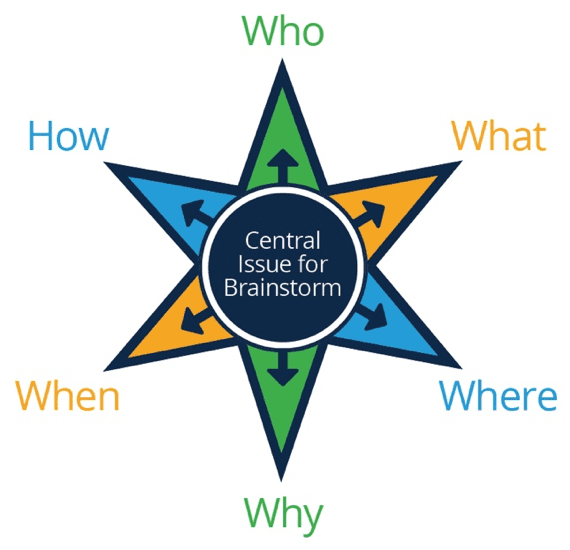

By going through this process you’ll identify gaps in your knowledge that you may want to fill during the research. It’s useful to think in terms of Who?, What?, When?, Where?, Why? And How?

Brainstorm all the questions you have in your head around: the problem; the objective; and your target group. Don’t censor yourself, write everything down. Keep going for as long as you can, it will get harder but often the deeper questions that take longer to form are the strongest, so persevere.

Once you’re happy you have all the questions down, cluster them into key themes. For example, shopping habits, consumption habits, pricing, promotions, and quality.

Step 3: Question selection

Now you have your key themes, it is important to review them against your objective. Discard any that will not help you achieve your objective. Select your strongest questions from each remaining theme and put them into a logical order, starting with more general questions first and then close in on the specifics.

A major frustration for respondents is the length of a survey. They can get fatigued during completion and the quality of their answers declines. You need to make your questions flow easily and ensure there are not too many. You’ll get better quality data from a survey that takes five minutes to complete, versus one that takes 20 minutes but you can hold respondent attention with great research questions that flow well.

Download our Individual Resource – Market research guide

This guide has been created to explain the information you can gain from market research, including customer satisfaction and product feedback, and best practices for applying methods you can use to obtain it.

Access the Market research guide

Step 4: Style, language & watch-outs

Here comes the really important step. You can have a critical and powerful question, which written poorly renders the data you get back as useless. The options you give for answers are just as critical as the question itself.

To make your questions engaging and simple to understand and answer you need to avoid several pitfalls in the way you write the questions you’ve chosen and the answer options you provide.

Stay incognito

It’s best to avoid revealing your brand at all, or until you have to. That way you get a clear result on the idea/product itself, rather than what’s called informed bias. Informed bias can affect their responses based on whether they like, or dislike, the brand in question.

Keep sentences short and the language simple

Avoid using technical words, jargon, and acronyms to make it simple for respondents to understand, otherwise, you risk getting false data or abandoned surveys. Also, avoid overly emotive language, you want their emotion, not your own, in the responses.

Use a mix of question styles

It does depend on your objectives and methodology. However, it is best to use a mix of closed questions, where options are given to choose from, and open questions, where they can free type their answers. This keeps the respondent engaged and gives you data for statistical analysis, as well as richer data to get respondents’ thoughts and ideas in their own words.

Free text responses can be useful for developing insights and finding consumer language for marketing communications. With closed questions, it may be relevant to add a ‘Don’t know’ or ‘Other (please specify)’ option to avoid respondents answering inaccurately because none of the given answers are correct for them. Be clear if they have to choose one answer or whether they should choose all that apply.

Avoiding bias is key

You want the respondents’ opinions, so it’s important to avoid leading them. If you ask what someone liked about a product or experience, you assume there was something they liked. This is leading. You can add ‘What, if anything, did you like…’ to help remove the bias. For the same reason, ask one question at a time, using separate questions to determine likes and dislikes. If they are asked in the same question you tend to get unbalanced answers.

Avoid hypotheticals

Try to avoid asking respondents what they would do, or how they would think in a given situation. You don’t get great quality responses. Claimed behavior is already a data quality risk and is inherent in this type of research. Thinking about what you might do is too hypothetical to be useful.

Don’t overlap answers

For mutually exclusive questions, like demographic age and income data, check that the answer options do not overlap, it’s easily done.

Be sensitive to data sensitivity

When asking for personal demographic and household-specific data like age, gender, and household income it’s advisable to give the option of ‘I’d rather not say’.

Embrace diversity

When providing options for answering demographic questions, ensure you are being inclusive and embracing diversity in the answer options. Survey Gizmo provides a useful guide to tackling gender questions.

Consider the role of the respondent

Are they the shopper or user, or both? Be explicit in the question of which role you are asking about. When asking about children, consider mixed families. In our example the mum may not consider stepchildren as ‘her children’, she’ll probably know what you mean but it’s better to ask about the children living at home to avoid frustration and confusion in the data.

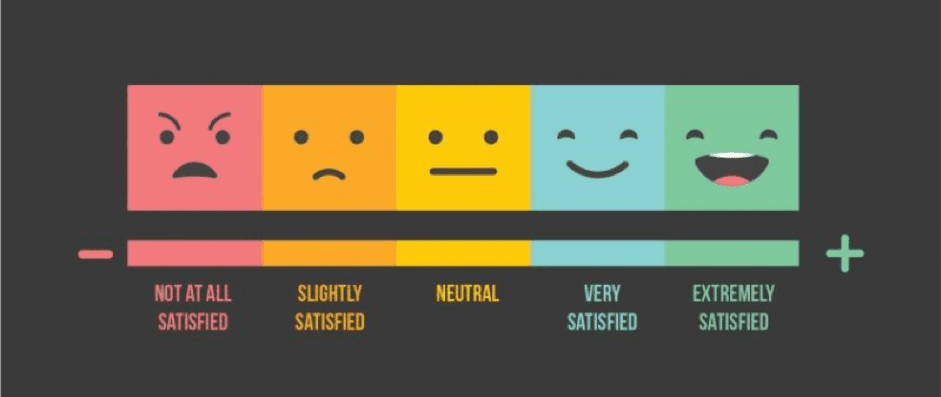

Use answer scales

Five or seven-point scales are the best for analysis, to help you get a better idea about the strength of feeling. The Likert Scale (for example a five-point scale from strongly agree to strongly disagree) is useful for analyzing the data later. In general, strong feelings lead to action.

Step 5: Build your questionnaire flow

At the top state, the purpose of the research and how valuable the responses will be, to make the respondent feel their time completing the survey is worthwhile. Avoid making the purpose personal, doing so tends to make respondents overly positive. They naturally don’t want to be negative to a person.

To build trust and get the respondent into the topic it’s good practice to start with some simpler closed questions before moving onto questions that need more thought and reflection. Break up the questions into sections and include a progress bar at the bottom to keep the respondents engaged. Most research tools offer this functionality.

Digital strategy in a time of crisis

Discover more blogs and ways to kickstart your organization's digital transformation strategy with actionable, practical online learning that gets results, fast!

See More

Step 6: Final checks

You’re ready to go, so with a few final checks, your survey will be ready to go live.

- Time how long it takes to complete. State the time required at the beginning so the respondents know how much time they should need.

- Make sure the survey works on all the main devices.

- Get a couple of people you know to test out the survey. Get their feedback on any questions they did not understand or struggled to answer and any frustrations they had with the flow.

It is often said that writing research questions is both an art and a science, and I can vouch for the fact it takes time and experience to learn what works, as much from getting it right, as by making mistakes. I’ve tried to share lessons from both. If you follow these six steps you will be able to start developing your skills to write great research questions, which give you the insight you need to meet your research objectives. Good luck!

If this blog post has left you wanting to know more, check out the Smart Insights Market Research Guide for an in-depth read into how to conduct market research.