While focus groups often reinforce assumptions, rapid testing is able to illustrate whether any assumptions about a product, audience, and go-to-market strategy are accurate.

It’s time to face the facts: focus groups aren’t cutting it anymore. These relics date back to 1937 when Princeton University researchers investigated what sort of messaging sent over radio airwaves would drum up the most support for the World War II effort.

Focus groups might have been the most viable option at the time, but there’s no reason researchers should continue to spend $2.2 billion worldwide on the questionable insights offered by modern focus groups. Participants might provide a slew of opinions about a product, but that feedback doesn't predict whether people will actually buy it.

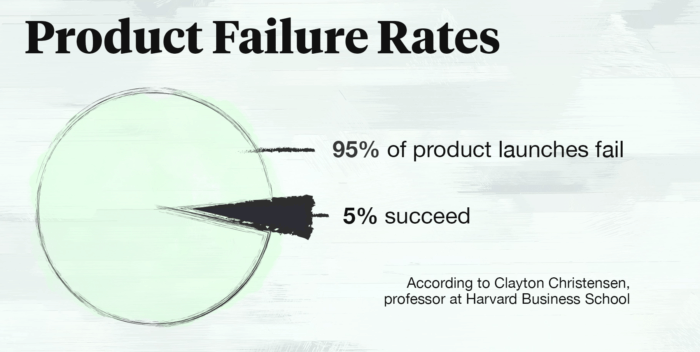

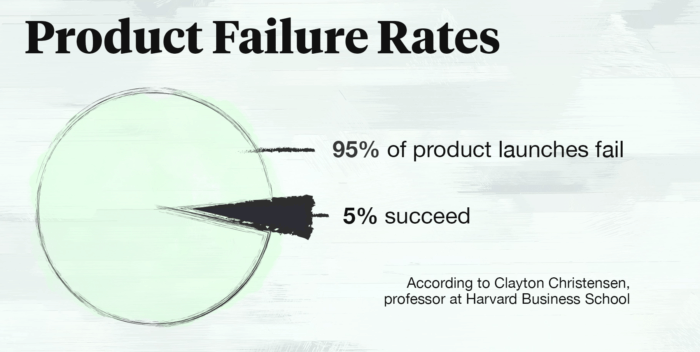

With so many companies mistakenly placing trust in focus groups, it’s no wonder Harvard Business School professor Clayton Christensen reports that 95% of the 30,000 new products created every year ultimately fail.

Download our Individual Member Resource – Testing market demand for a new business idea or product

Use this guide to gauge product/market fit, develop more commercially viable ideas, and avoid significant investments in ideas that are unlikely to give a profitable return.

Access the Testing market demand for a new business idea or product

The consequences of inaccurate assumptions

All the incredibly meaningful work that goes into the design and prototyping processes gives product leaders and marketers a false sense of confidence and security. They feel like they’ve done ample research, collected more than enough data, and modeled that data to build accurate predictive forecasts that they can rely on. In reality, they’re basing critical decisions on misleading assumptions.

In my experience, the most common incorrect assumptions are often based on the recommendations of clients. For example, a company that sold loyalty software through payment providers had multiple clients ask for an app that customers could use to store different loyalty cards. By all accounts, the app solved real-world problems — customers have to carry an excessive number of loyalty cards that are easily lost and forgotten, and those cards bog down an otherwise smooth checkout process.

When the company finally caved to client demand and created the software, it was a massive flop. Clients didn’t purchase it, and customers didn’t download the accompanying app. The moral of the story? The reason for creating a product isn’t necessarily the reason people will buy or use it.

All companies make assumptions, from small startups to large organizations with complex innovation pipelines. While focus groups often reinforce these assumptions, rapid testing is able to illustrate whether any assumptions about a product, audience, and go-to-market strategy are accurate.

Better insights through rapid testing

For market validation, it’s important to call out assumptions and design controlled, real-world tests to see if they hold true. Focus groups and other market research can't provide those nimble, actionable insights.

This is where rapid testing shines. Through this method, you'll test highly targeted tactics, messages, and landing experiences against each other in real-time with real consumers. Use small spend to complete specific tests against your assumptions. The results will show you whether your target audience will purchase your product at a price that produces a profit. Let those tests run for a few weeks, and then make adjustments to your campaign as necessary.

Rapid testing can validate all types of physical, digital, software, and service products for both B2B and B2C sales. For example, when we worked with a company launching a new outdoor game targeted at college students, our research defied our original assumptions. We conducted rapid testing to find the actual audience for the game. We found that parents — not students — were most likely to purchase the game.

Once we identified the real customer, we researched when and why they bought it, the highest converting channels, and the most effective messaging. We then used these insights to help the company create a successful product launch. Had the manufacturer continued with its original, seemingly safe assumptions, the release of the game could have been a failure.

Rapid testing in action

Rapid testing can answer all kinds of questions that focus groups gloss over, but here are four of the most important insights digital marketers can glean from the process:

1. Customer validation

You’ve probably completed boatloads of customer research, including focus groups before you sat down to design and produce a prototype. People said they would buy the product, so now it's time to test that. And if they’re buying, you need to determine why.

With rapid testing, you can set different targets to validate who buys as well as their reasons for purchasing. In almost every test we've run, a different or unexpected audience emerges. Importantly, the "why" behind the purchase can change your messaging, channels, and volume projections.

2. Go-to-market channels

The easiest channel to identify and test is the one where you see people buying, but knowing that a channel drives purchases doesn’t illustrate the why. Why did these individuals change their routine — a possibly stop using a competitor’s product — and start addressing their problems with yours?

It's likely that you're making assumptions based on the channel itself. Instead, start with the customers themselves and backtrack along their journey to conversion. When you know why customers are behaving in a certain way, you can take those insights and apply them to many more channels than just your current sales leader.

3. Value proposition messaging

You’ve probably put a ton of time and energy into ensuring that your product solves a critical problem for your target audience, but do you know which message ultimately connects at a level that drives sales?

In focus groups, people generally understood the value proposition and were eager to buy. In a different context, your messaging might not motivate people to take action. Test messaging outside focus groups in real-world scenarios to gain important insights that will drive sales in any number of channels.

4. Revenue projections

You probably can’t assign resources to product development without revenue projections, but those projections should be updated once you gain insights about your customers and the most effective channels of communication.

Use the data you collect against your forecast to influence others in your company. Confidently access the funding you need and set realistic and motivating goals for sales and marketing teams based on facts instead of assumptions.

Final thoughts

Assumptions often feel like accurate assessments, which is why they plague the product development cycles of companies around the world. When a new product is proposed and teams are excited about the possibilities, questioning assumptions can feel like raining on a parade. Still, the additional weeks it takes to conduct your due diligence can make all the difference between a failed launch and a stunning success. Look before you leap with rapid testing.

Tessa Burg is

Tenlo's Vice President of UX and Technology Strategy. She started her career as a developer before following her passion for people-generated data into marketing, and she has held roles in marketing and software product management on both the client and agency sides of the business. She combines that experience with agile principles to execute Tenlo’s rapid marketing testing, which focuses on identifying and forecasting clients' most effective experiences and sales channels for scaling successful products or launching new innovation.