Does your digital branding match your audiences search interests?

Defining the metrics of success is of the utmost importance when establishing a brand online. One of the most important metrics which define a brand’s true strength is one that is often overlooked, an audience interest graph. A brand’s true strength is the perception that it holds in the minds of its consumers. There are many metrics that online marketers use to define a brand’s success, however an audience interest graph is most often either unheard of or completely overlooked. This happens mostly because there are so many other metrics available that are easy to understand and completely misrepresented in the industry, such as monthly number of visitors, average time on page, social outreach metrics such as number of likes, shares or comments, bounce rates, click through rate, average cost per click etc. What people fail to understand is that this speaks nothing about a brand’s true strength or recall value. How then should one define this very valuable metric of a brand’s overall online grasp within its consumers or target audience? How does a brand know that it has successfully positioned itself in the minds of its consumers?

An audience interest graph can help here! It can be defined in many ways however in essence; it is a list of interests of the consumers of any brand represented in a graphical format. The “kind” of brand is defined by the “kind” of its audience and the kind of audience is best defined by their interests, therefore by the transitive property, a good metric of defining “a kind of a brand” is “the kind of interests of its audience”. It is a simple, quick and effective way of defining the strength a brand holds in the digital world as it defines the kind of audience it attracts.

When a brand is about to be launched there is extensive research done to define the “personality” of the ideal consumer of that brand. An audience interest graph is a great way to prove that a brand has hit its consumer personality definition goal within a given time frame.

Let’s look at some examples:

Apple vs. New Entrants

Here Apple is a developed brand and the rest are developing brands. Therefore we should see how mature Apple’s audience’s interest graph is vs. that of the rest of the brand’s audience’s graphs and it should show us a stark difference.

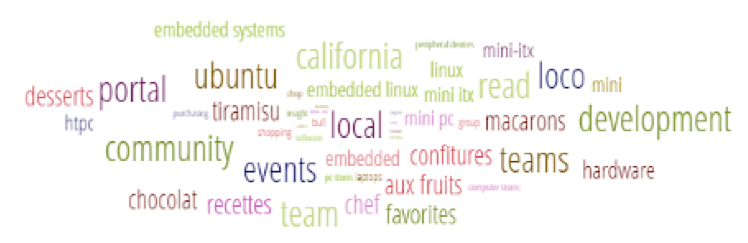

Apple

Here we can clearly see that the audience that reaches Apple’s website is already aware about the brand and has shown interest in visiting similar websites, therefore their interests are closely related to what Apple’s audience should ideally look like. Their audience are people who are interested in the Mac OS, tech blogs, apple news, iPad, Firefox, android & technology news. (Granted there are a few random parameters showing)

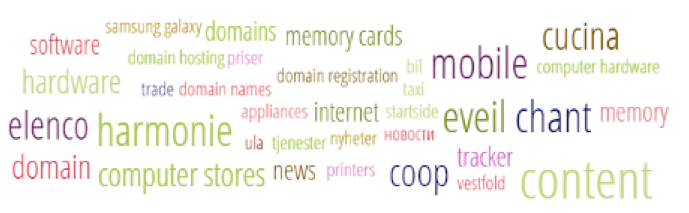

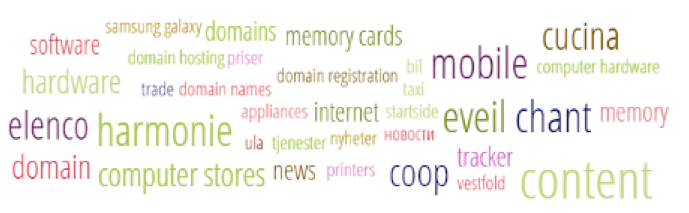

Kazam

Kazam’s audience are not necessarily showing such strong interest in any particular sort of a genre. It can clearly be seen that the elements are completely random and unrelated to the smart phone sector in any way. Kazam has existed in the market for 3 years now and yet shows very little sign of a coherent audience set. Ideally this grap h should start to show tech savvy audience interested in cell phones if its branding campaigns are consistent and given that it succeeds in positioning itself as such. We can see that this audience interest graph doesn’t really show any strong indicator of a particular “kind” of audience when compared to Apple. Of course one could forcefully define an audience segment looking at that graph however that is imprudent to say the least.

Wileyfox

This graph also shows something similar to Kazam’s audience a totally random distribution with no particular common factor relating it to Wileyfox’s brand image. This is also mostly because neither one of Wileyfox or Kazam have really tried to brand itself strongly at all. Most of these cell phone manufacturers/sellers have focussed on immediate sales rather than overall branding success.

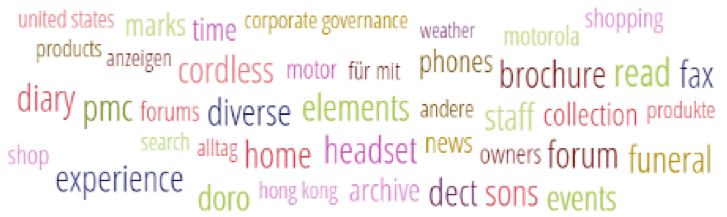

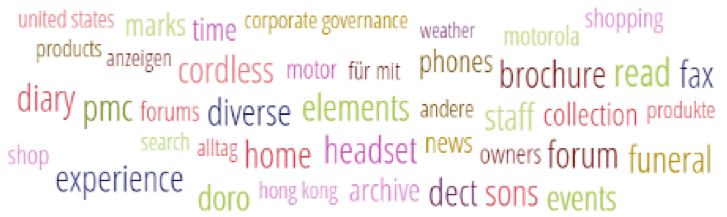

Doro

Doro’s audience interest graph follows closely in line with Kazam and Wileyfox without any particular branded genre to associate the audience to. Most of the audience is showing random signals.

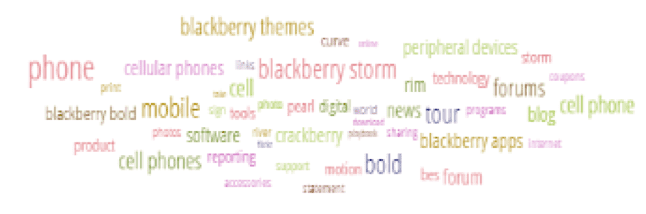

To end the cell phone segment we look at a great branding success which has now begun to collapse:

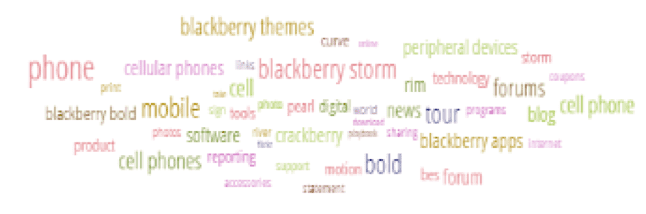

Blackberry

This graph shows interest in cell phones and specifically blackberry products and even RIM is in there somewhere. This shows that the audience can be categorized into having understood the brand message that the company was delivering.

For developing brands, the audience is usually in the “discovery” phase of formulating a brand’s image or understanding its communication. In this phase the audience will be driven to a brand’s websites via several different channels and not necessarily a “direct acquisition” path. Therefore the audience interests would vary strongly when compared to a developed brand’s audience. A developed brand’s audience will have already been subliminally affected by its branding strategy and would now have strong direct recall of the brand and similar interests to its “defined” audience. In other words, the brand would hold strong equity on the basis of this audience. In the traditional model of AIDA (Attention, Interest, Desire and Awareness) the “discovery phase” can be termed as the Attention and Interest phase. The Desire and Action are foregone conclusions in the “developed equity” stage.

Now let’s analyse the effectiveness of this method using various sectors at random.

Executive Shaving Company vs. Truefitt and Hill

Executive shaving company operates purely in the online realm of the men’s grooming sector within the UK and Truefitt & Hill operates in the traditional grooming sector with actual physical locations within the UK.

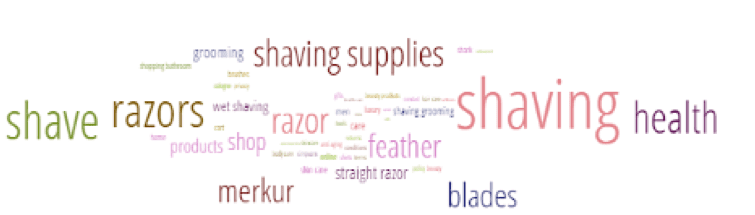

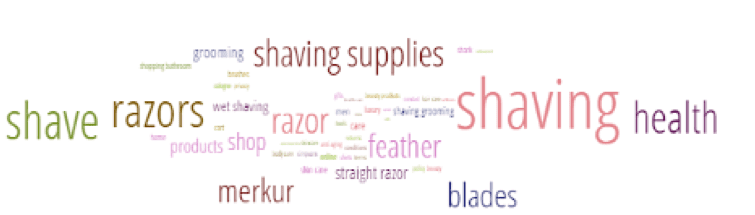

Executive Shaving Company

This brand shows a highly focussed set of audience.

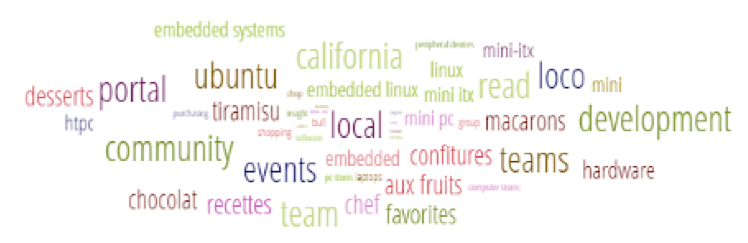

Truefitt & Hill

This brand shows random signals as it hasn’t focussed on online branding.

McDonalds vs. Honest Burgers

McDonalds shows an audience interest graph with fast food, restaurants, burgers, menu, nutrition etc.

Honest Burgers shows a graph describing finance & job related terms. Not what it wants to be branded as for sure.

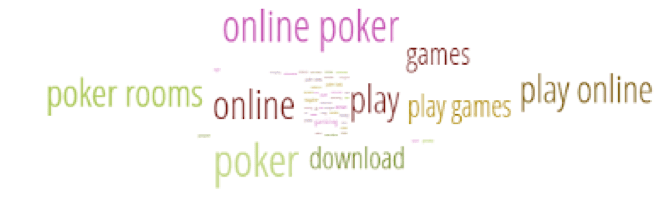

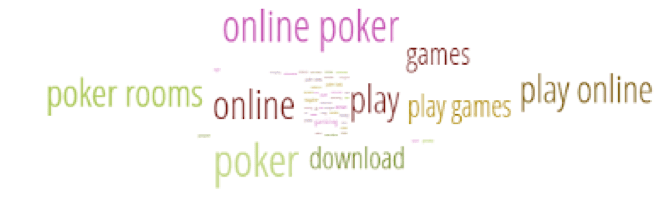

The First Two Results for Poker in the UK

888 Poker is an online poker playing website ranks as the first search result within the UK.

Pokerstars ranks second within the UK.

One can see the immediate difference as the former shows a more focussed audience while the latter shows a highly confused audience set (with maybe 1 or 2 poker related terms.)

Conclusion

The same exercise can be carried out for absolutely any brand of one’s own choosing, within the geography of one’s own choosing, but the results will always be the same. A developed brand has a highly focussed audience interest graph while a developing one shows a lack thereof.

It can be seen how relevant an audience interest graph can be as an indicator of a brand’s true strength within its online audience. Therefore in today’s world of brand’s being built purely based on their online presence, this metric should be one of the most important branding success indicators. Even though a brand might be selling well online, it doesn’t necessarily mean that it has developed a strong brand online. Simply put, a strong brand shows a strong audience interest graph.

Thanks to

Akshat Misra for sharing their advice and opinions in this post.

Akshat is an independent marketing consultant with experience in market research, data analytics and digital marketing. Having worked with some of the biggest brands in the world and helping them set up their digital marketing efforts he has now branched out on his own to help the smaller entities that do not have access to the kind of resources available to the bigger brands. You can connect with Akshat on

LinkedIn.

Note: All images are courtesy SimilarWeb

Thanks to

Thanks to