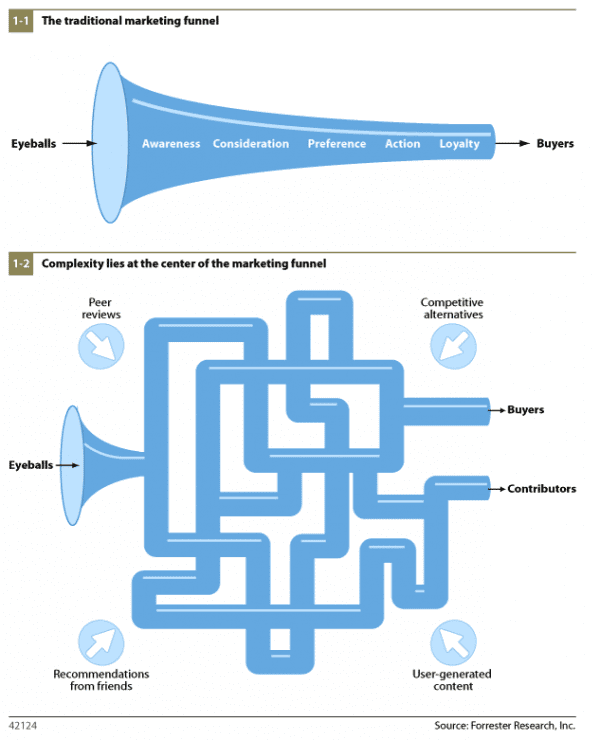

A couple of weeks ago I rolled out one of my favourite slides, the Forrester ‘spaghetti’ view of the online customer journey. I’m fond of Forrester’s reworking of the traditional sales funnel for the digital age. On the one hand, the reworked sales funnel probably is a more accurate picture of the way that people make purchase decisions online. But it isn’t easy to see how it would drive sensible digital strategies back in the real world:

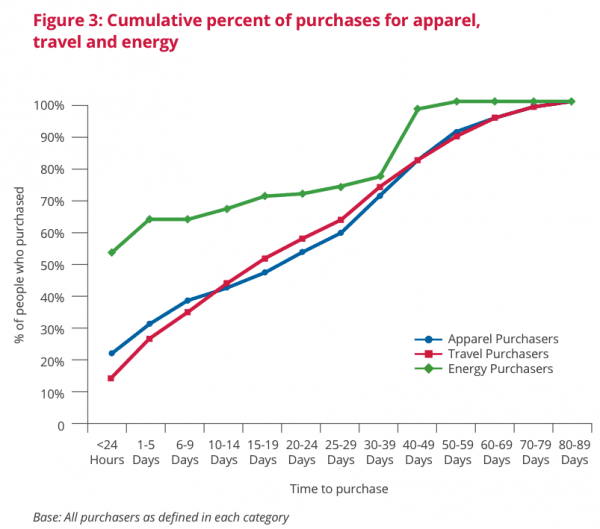

To help gain better insight, we need to add the time dimension. Research can can show that decision times vary a lot by category and they're not short. This research found that one in three purchases happened over a month after initial research started.

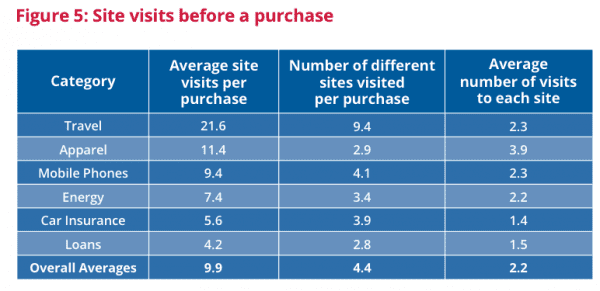

Then there is the range of sites visited to inform the decision - an average of nearly 10 sites per visit with higher involvement purchases like mobile phones, clothing and travel rating involving many sites and 2+ visits to each site.

The source by the way is a great piece of research from Google last year: Beyond last click: Understanding your consumers’ online path to purchase. The data behind it comes from a browser plugin that tracks everything UK-based panel members did as they researched their purchase, and not from click stream data which won't show usage of different sites to support the decision.

Reviewing individual paths can be illuminating. The diagram, also from the research, shows a single customer journey leading to the purchase of a holiday.

The first thing I like about this journey is the way it sums up the futility of life. After 28 days of pretty rigorous online research, this person makes exactly the same search they made on day one, visits exactly the same site (First Choice) and probably buys the same holiday they looked at a month earlier.

If you are offended by me making wild generalisations based on small amounts of data, please look away now!

We don’t see much evidence of a traditional ‘funnel’ getting progressively narrower here. If anything, the more this person searches, the more competitive alternatives they become aware of. In fact across the 28 days, the research identifies an incredible fourteen separate quotes being generated.

The quest starts off being price focused, but then around day seven something interesting happens. We see visits veering away from brand sites and towards Bing Maps, Trip Advisor and Holiday-Truths.com.

What’s happening here I think is that this person is happy with Corfu as a destination, has benchmarked some typical prices, but is now wondering about the quality of each hotel. And the best place to get objective information about this is of course from people who have already been there and have reviewed the hotel on social websites.

As for Bing and Google Maps, this is possibly looking for the answer to questions like “How long is the airport transfer likely to be?”, “How far is the hotel from the beach?”, “How close is it to the middle of town?”, etc.

This is a classic example of how social media works within the buying process. It is all about reassurance, quality control, weeding out the negatives. But it is NOT as you can see here prompting direct clicks to brand websites – and hence it is really hard to track.

Put it another way, if you are trying to assess the value of social in a binary way around how many clicks and sales it is generating, you are missing the point.

The other thing to take out of this is just how complicated the research process is for high value purchases like this.

Finally a confession. I told a bit of a lie at the top of this post when I said that this showed a picture of everything the user has done. There is much more here than we normally see, but there is ton of missing activity including:

- Any activity on other devices as this research only looked at the primary home PC.

- The impact of email marketing – those fourteen quotes undoubtedly generated a lot of follow up emails which must have made a difference.

- Retargeted display activity – again, all these site visits means that this person has been cookied up through half the travel sector so he must be seeing A LOT of travel advertising.

On top of all this, we are only looking at one piece of the travel jigsaw here. Let’s imagine that this is a person booking hotel only, so he still has to consider flights, car hire etc.

In fact as the figure below shows, the research also maps out the entire flow of visits between different segments of the travel industry. As Google’s commentary dryly notes: “Overall navigation patterns in travel remain complex, right up until the moment of purchase.”

Too true!

Thanks to Mike Teasdale, founder and Planning Director at

Thanks to Mike Teasdale, founder and Planning Director at