I was recently listening to an interesting talk by Dave Wieneke where he looked at the way brands need to change how they engage with consumers. One of the nuggets he shared, looked at the relative importance of company Facebook page visits against their main website visits. So I dug into the original data - 2011 research from Webtrends and Adgregate (PDF) and it tells a very interesting story I thought was worth summarising.

For many companies now, particularly those with non-transactional sites, visitor figures are in decline, while their Facebook visitors are growing.

I thought I would share this here, since it prompts important questions of how serious companies are about creating a strategy to engage their audiences through Facebook and whether they are allocating the right level of resources between website management and Facebook, either too much or too little.

It also suggests questions should be asked about the balance of media investments; whether they should be used to route visitors to the website as traditionally, or to Facebook and other social presences.

This is the story this research tells:

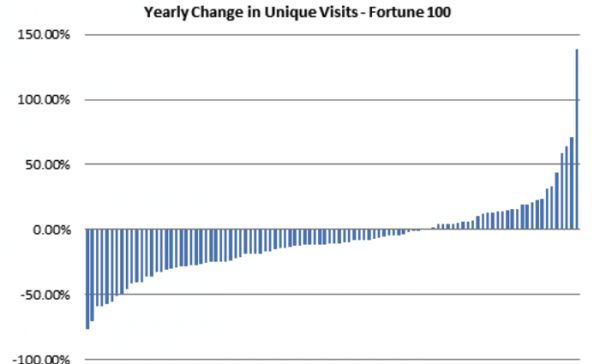

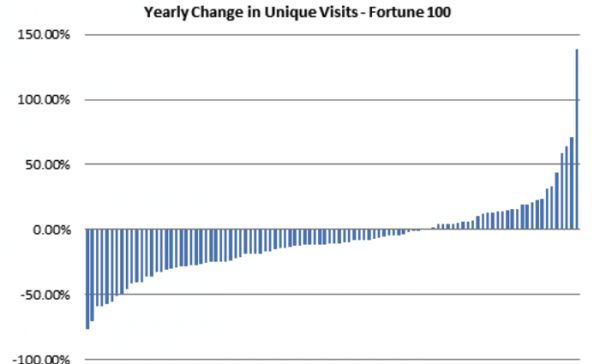

1. Visits to the majority of corporate websites are in decline

Looking at the year-on-year change in visits to Fortune 100 sites to 2010, the majority are declining, although of course there are similar levels of growth in others:

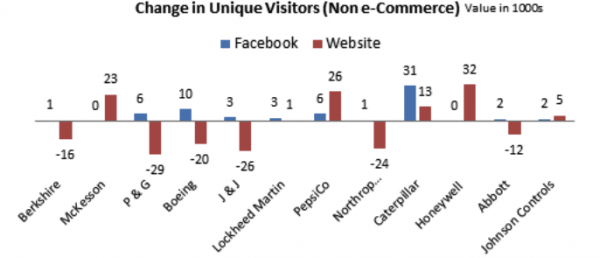

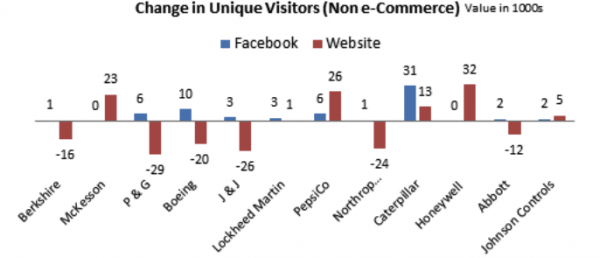

2. Growth in Facebook (and other social presences) occurs at the expense of corporate sites

In many cases while corporate sites are declining in their level of unique visitors, Facebook visits are increasing:

Of course, this study looks at Facebook only, traditional website audiences are also visiting YouTube, Twitter and LinkedIn which are excluded.

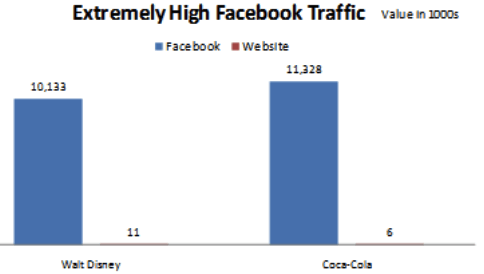

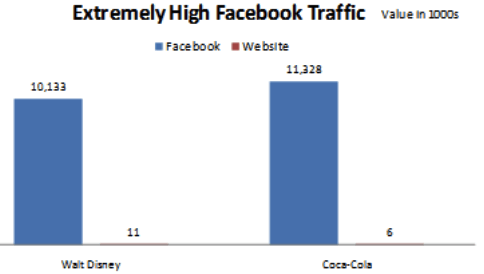

3. For some brands Facebook dominates

You’ll know this, but this graphic makes the point forcefully:

In these cases, the dominance of Facebook is likely due to a deliberate strategy to focus investment and marketing resource into Facebook.

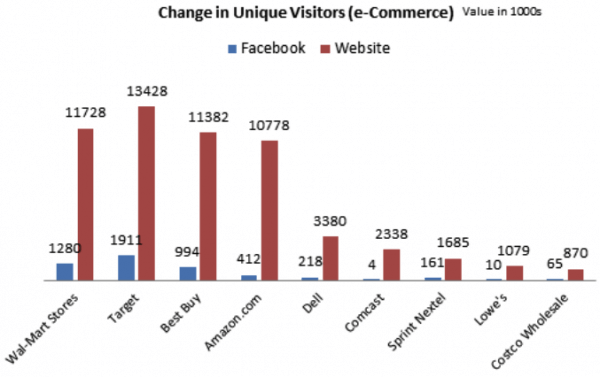

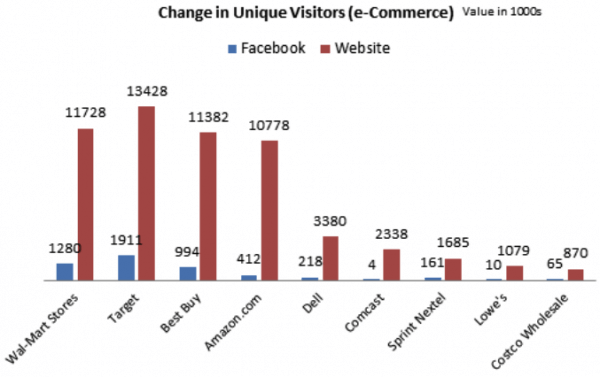

4. Retail and transactional sites are different

The report also looks at changes for major US retailers. Here both forms of presence are increasing:

Interesting stuff, really showing the changes we've seen in online behaviour over the last few years now.

This form of analysis looks a useful benchmarking analysis to perform for any company sector. Review growth in social media against changes in the traditional site using the many free tools available for benchmarking visitor traffic and social presences. I’d be interested to hear about any companies who have done this type of analysis, the type of tools used and what is has showed.