A case study focusing on eBay marketing strategy: The facts, figures, and strategy behind their highest quarterly revenue yet

This case study summarizes the strategic approach used by eBay to take advantage of increased consumer adoption of the Internet. In this article I'll be summarizing eBay's objectives, strategy and proposition and key risks. Ebay marketing strategy updates will be added at the top of the case study.

This case study summarizes the strategic approach used by eBay to take advantage of increased consumer adoption of the Internet. In this article I'll be summarizing eBay's objectives, strategy and proposition and key risks. Ebay marketing strategy updates will be added at the top of the case study.

2021 eBay marketing strategy update: E-commerce giant records highest quarterly revenue Q1 2021

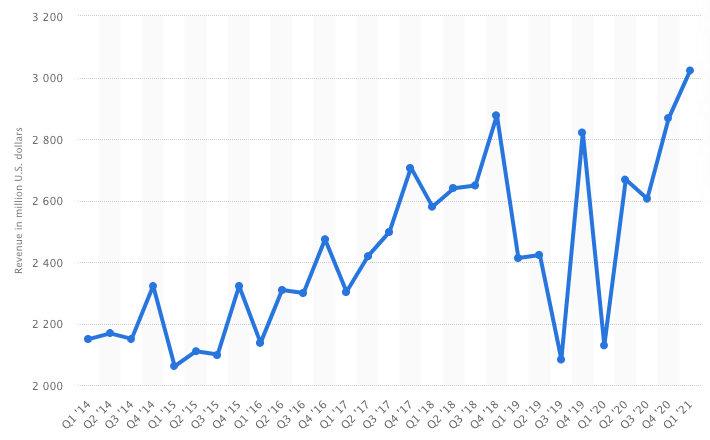

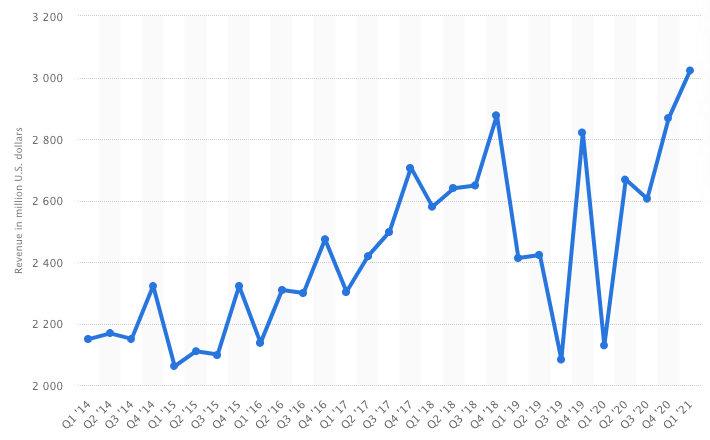

Ebay has had a fascinating year. The quarterly revenue chart below depicts both highs and lows for this company in the last 12 months. Plunging to a low revenue of US $2,129 million in quarter 1 of 2020, the company then rocketed to it's highest recorded quarterly revenue of US $3,023 in quarter 1 of 2021. That's YOY growth of US $894.

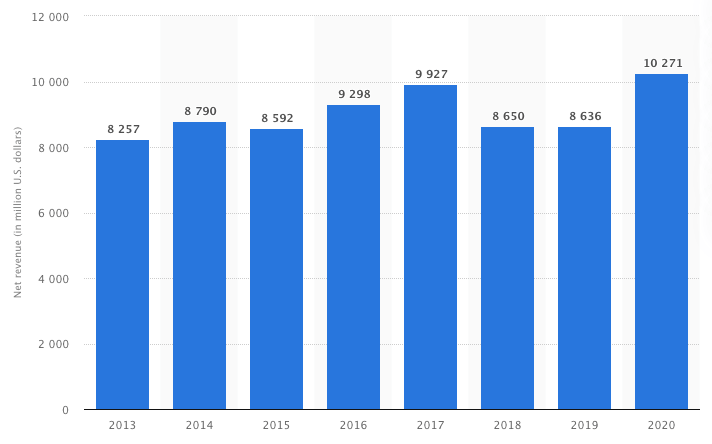

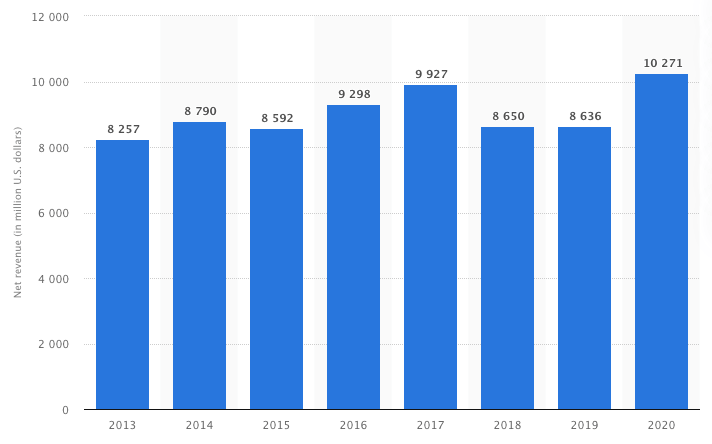

Moreover, ending the year on a high, Ebay finished 2020 with it's highest annual net revenue so far, at US $10,271 million. This demonstrates that e-commerce is still a growing sector, despite the initial market uncertainty during the onset of the pandemic. Lessons learnt from studying Ebay marketing strategy - react to market challenges to create new opportunities, to stay ahead in a competitive environment.

EBay ended 2020 with 185 million active buyers, up 11 million from the end of 2019. EBay acquired 3 million new shoppers in the second half of the year, even as panic-buying essentials slowed down and stores opened back up, leading experts to believe eBay’s turnaround may last post-pandemic:

“EBay is proving that it has the ability to sustain the gains it is seeing from COVID,” says Ygal Arounian, an analyst at Wedbush Securities. “We expect these trends to increasingly become ingrained in consumer behavior, which will support eBay in 2021.”

Free digital marketing plan template

Our popular marketing planning template is structured across the Smart Insights RACE Framework. Join Smart Insights as a Free Member to download our digital marketing plan template today

Access the Free digital marketing plan template

2018 stat update: Over 50% of purchases on eBay in the UK from mobile

At the end of 2017 eBay had 168 million 12-month active buyers, an increase from 90 million active in 2010. Nearly two-thirds of transactions are now international. The challenge of growing the business can be seen by the near static GMV in the last three years. Globally 58% of GMV is now transacted on smartphone.

Updating eBay brand positioning using traditional media

In an interview with eBay UK marketing director Gareth Jones, explained that:

“We don’t want to be defined by that online car boot sale reputation anymore. We need to get people to consider eBay in a completely different way. The UK is the petri dish for testing a new approach to rebuilding the brand globally. It is all about a shift away from the marketplace and over to being the ultimate shop”.

He is candid that a past focus on prioritising digital channels has had a “small impact” on changing eBay’s perception. Despite stating we’re in an age of digital-based marketing, he believes TV is the best channel for brand building. This is based on regional tests that proved TV is the best place to get people to reap-praise eBay as a brand:

“TV is still on fire and a wonderful medium to get neurons into people’s brands in order to rewire their perceptions. If you ask someone where they are shopping on Black Friday then TV is the best place to put eBay at the front of their consideration set.”

Context

It’s hard to believe that one of the most celebrated dot-coms has now been established nearly 20 years. Pierre Omidyar, a 28-year-old French-born Software Engineer living in California coded the site while working for another company, eventually launching the site for business on Monday, 4 September 1995 with the more direct name ‘Auction Web’.

Legend reports that the site attracted no visitors in its first 24 hours. The site became eBay in 1997 and by 2012, it had 112 million active users globally defined as users who have bid, bought or listed an item during the preceding 12 month period, with the total worth of goods sold on eBay $60 billion, which is equivalent to $2,000 every second. Total revenue was $8.7 billion.

eBay's Mission

eBay describes its purpose as to ‘pioneer new communities around the world built on commerce, sustained by trust, and inspired by opportunity’.

eBay’s 2016 report describes the company’s view on current marketing approaches of exploiting Big Data and Artificial Intelligence.

To deliver the most relevant shopping experience, we continue our efforts to better understand, organize and leverage eBay’s inventory.

With our structured data initiative, we are able to begin organizing our vast inventory around products rather than listings and aggregate insights into supply and demand. We continue to broaden the coverage of structured data, which enables us to create and start rolling out new consumer experiences that are modern, simple and differentiated.

One of our goals is to deliver a more personalized shopping experience by determining what products to show our consumers and highlight the incredible price and selection advantages that eBay often provides across categories.

eBay's Revenue model

The vast majority of eBay’s revenue is for the listing and commission on completed sales. While it is best-known for auctions, 80% of UK sales now coming through new items of which the majority are fixed price. UK marketing director Gareth Jones told Marketing Week he wants to focus on top-of-the-funnel consideration: "it wants British consumers to see it as the first choice for buying new items as opposed to its historic online car boot sale reputation".

For PayPal purchases an additional commission fee is charged.

Margin on each transaction is phenomenal since once the infrastructure is built, incremental costs on each transaction are tiny – all eBay is doing is transmitting bits and bytes between buyers and sellers.

Ebay marketing strategy proposition

The eBay marketplace is well known for its core service which enables sellers to list items for sale on an auction or fixed-price basis giving buyers the opportunity to bid for and purchase items of interest. Software tools are provided, particularly for frequent traders, including Seller’s Assistant, Selling Manager and Selling Manager Pro, which help automate the selling process, plus the Shipping Calculator, Reporting tools, etc.

Today over 60% of listings are facilitated by software, showing the value of automating posting for frequent trading.

An example of a new Shopper feature which is part of its OVP is the eBay ShopBot on Facebook Messenger.

This uses artificial intelligence to provide a personalized shopping assistant that helps people find the best deals from eBay’s one billion listings.

According to the SEC filing, eBay summarises the core messages to define its proposition as follows:

For buyers:

- Trust

- Value

- Selection

- Convenience.

In 2007, eBay introduced Neighbourhoods where groups can discuss brands and products they have a high involvement with.

For sellers:

- Access to broad global markets

- Efficient marketing and distribution

- Opportunity to increase sales.

In January 2008, eBay announced significant changes to its marketplaces business in three major areas: fee structure, seller incentives and standards, and feedback. These changes have been controversial with some sellers, but are aimed at improving the quality of experience.

Detailed Seller Ratings (DSRs) enable sellers to be reviewed in four areas: (1) item as described, (2) communication, (3) delivery time and (4) postage and packaging charges. This is part of a move to help increase conversion rate by increasing positive shopping experiences.

For example, by including more accurate descriptions with better pictures and avoiding excessive shipping charges. Power sellers with positive DSRs will be featured more favourably in the search results pages and will gain additional discounts.

Risk factors

Fraud is a significant risk factor for eBay. BBC (2005) reported that around 1 in 10,000 transactions within the UK were fraudulent; 0.0001% is a small percentage, but scaling this up across the number of transactions, this is a significant volume.

To counter this, eBay has developed 'Trust and Safety Programs’ which are particularly important to reassure customers since online services are prone to fraud.

For example, the eBay feedback forum can help establish credentials of sellers and buyers. Every registered user has a feedback profile that may contain compliments, criticisms and/or other comments by users who have conducted business with that user. The Feedback Forum requires feedback to be related to specific transactions and Top Seller status was introduced in 2010 to increase trust in the service.

There is also a Safe Harbor data protection method and a standard purchase protection system.

The fees model that eBay uses is often changed and this can cause problems with users, but the impact is calculated that it does not affect overall sales. In their 2012 SEC filing eBay note: 'We regularly announce changes to our Marketplaces business intended to drive more sales and improve seller efficiency and buyer experiences and trust. Some of the changes that we have announced to date have been controversial with, and led to dissatisfaction among, our sellers, and additional changes that we announce in the future may also be negatively received by some of our sellers. This may not only impact the supply of items listed on our websites, but because many sellers also buy from our sites, it may adversely impact demand as well'.

In common with other global platforms like Amazon, Facebook and Google, eBay note the potential threat of the shift to tablet and smartphone platforms noting that one risk factor is: 'Our ability to manage the rapid shift from online commerce and payments to mobile and multi-channel commerce and payments'.

There is also the common risk factors for online pureplays of retaining an active user base, attracting new users, and encouraging existing users to list items for sale, especially when consumer spending is weak.

Competition

Although there are now few direct competitors of online auction services in many countries, there are many indirect competitors. SEC (2012) describes competing channels as including online and offline retailers, distributors, liquidators, import and export companies, auctioneers, catalogue and mail order companies, classifieds, directories, search engines, products of search engines, virtually all online and offline commerce participants and online and offline shopping channels and networks. In their SEC filing, eBay states that the principal competitive factors for the Marketplaces business include the following:

- ability to attract, retain and engage buyers and sellers;

- volume of transactions and price and selection of goods;

- trust in the seller and the transaction;

- customer service; and brand recognition.

Amazon is one of the biggest competitors since it also has marketplace sellers integrated into its products listings. It’s latest SEC filing notes: Consumers and merchants who might use our sites to sell goods also have many alternatives, including general e-commerce sites, such as Amazon and Alibaba, and more specialized sites, such as Etsy.

Competitive factors today are listed as:

- ability to attract, retain and engage buyers and sellers;

- volume of transactions and price and selection of goods;

- trust in the seller and the transaction;

- customer service;

- brand recognition;

- community cohesion, interaction and size;

- website, mobile platform and application ease-of-use and accessibility;

- system reliability and security;

- reliability of delivery and payment, including customer preference for fast delivery and free shipping and returns;

- level of service fees; and

- quality of search tools.

Before the advent of online auctions, competitors in the collectables space included antique shops, car boot sales and charity shops. Anecdotal evidence suggests that all of these are now suffering. Some have taken the attitude of ‘if you can’t beat ’em, join ’em’. Many smaller traders who have previously run antique or car boot sales are now eBayers. Even charities such as Oxfam now have an eBay service where they sell high-value items contributed by donors. Other retailers such as Vodafone have used eBay as a means to distribute certain products within their range.

Objectives and strategy of eBay

The overall eBay aims are to increase the gross merchandise volume and net revenues from the eBay marketplace. More detailed objectives are defined to achieve these aims, with strategies focusing on:

- Acquisition – increasing the number of newly registered users on the eBay marketplace.

- Activation – increasing the number of registered users that become active bidders, buyers or sellers on the eBay marketplace.

- Activity – increasing the volume and value of transactions that are conducted by each active user on the eBay marketplace.

The focus on each of these three areas will vary according to strategic priorities in particular local markets. eBay marketplace growth was driven by defining approaches to improve performance in these areas.

- First, category growth was achieved by increasing the number and size of categories within the marketplace, for example Antiques, Art, Books, and Business and Industrial.

- Second, formats for interaction. eBay Stores was developed to enable sellers with a wider range of products to showcase their products in a more traditional retail format including the traditional ‘Buy-It-Now’ fixed-price format.

eBay has constantly explored new formats, often through acquisition of other companies, for example through the acquisition in 2004 of mobile.de in Germany and Marktplaats.nl in the Netherlands, as well as investment in craigslist, the US-based classified ad format. Another acquisition is Rent.com, which enables expansion into the online housing and apartment rental category. In 2007, eBay acquired StubHub, an online ticket marketplace, and it also owns comparison marketplace Shopping.com.

Finally, marketplace growth is achieved through delivering specific sites localized for different geographies as follows.

You can see there is still potential for greater localization, for example in parts of Scandinavia, Eastern Europe and Asia. Localized eBay marketplaces:

- Australia

- Austria

- Belgium

- Canada

- Singapore

- South Korea

- Spain

- France

- Germany

- Hong Kong

- India

- Ireland

- Sweden

- Switzerland

- Italy

- Malaysia

- Netherlands

- New Zealand

- Philippines

- United Kingdom

- United States

In addition, eBay has a presence in Latin America through its investment in MercadoLibre.

eBay marketing strategy for growth

In its SEC filing, success factors eBay believes are important to enable it to compete in its market include:

- ability to attract buyers and sellers;

- volume of transactions and price and selection of goods;

- customer service; and brand recognition.

This implies that eBay believes it has optimized these factors, but its competitors still have opportunities for improving performance in these areas which will make the market more competitive. According to its 2010 SEC filing: Our growth strategy is focused on reinvesting in our customers by improving the buyer experience and seller economics by enhancing our products and services, improving trust and safety and customer support, extending our product offerings into new formats, categories and geographies, and implementing innovative pricing and buyer retention strategies.

Updates on eBay marketing strategy information

Found our eBay marketing strategy blog useful? Keep up to date with the latest trends and innovations with expert advice and real-life case studies so you can win more customers. Get started today.

Free digital marketing plan template

Our popular marketing planning template is structured across the Smart Insights RACE Framework. Join Smart Insights as a Free Member to download our digital marketing plan template today

Access the Free digital marketing plan template

This case study summarizes the strategic approach used by

This case study summarizes the strategic approach used by