What's new in the travel industry? Keep up to date with the latest trends and innovations to streamline your strategy

The multichannel marketing approach

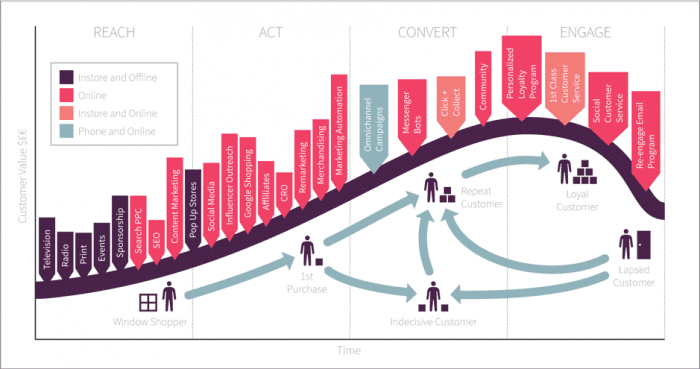

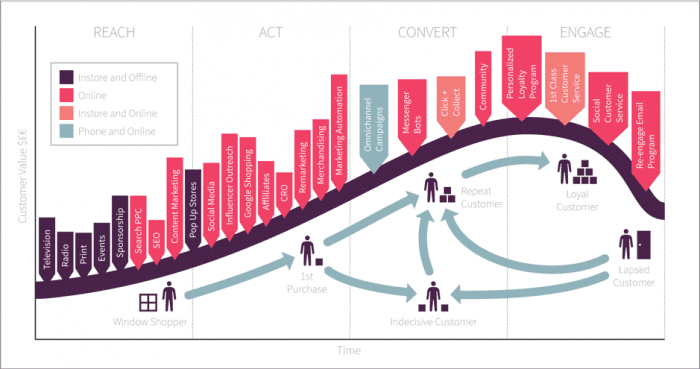

It is vital that there is a multichannel marketing plan in place for all online travel agents and comparison sites to thrive. Travellers are using more than one channel to research and book holidays and excursions – it is important now more than ever to ensure their experience is optimized for multiple devices and channels that contribute to an effective customer journey.

Download our Premium Resource – Travel ecommerce marketing trends 2018

Our specialist marketing trends resource for the travel sector will help keep up to date in the industry and help you benchmark your digital marketing approach against others. The online guide is full of examples, case studies and metrics to help you drive your travel marketing forward.

Access the

Our visual shows typical touch-points relevant for the travel market across the Smart Insights RACE planning system. The equivalent of Google Shopping in retail is not available for packages or hotels, but does impact flights, so this could change in future.

Smart Insights RACE planning system

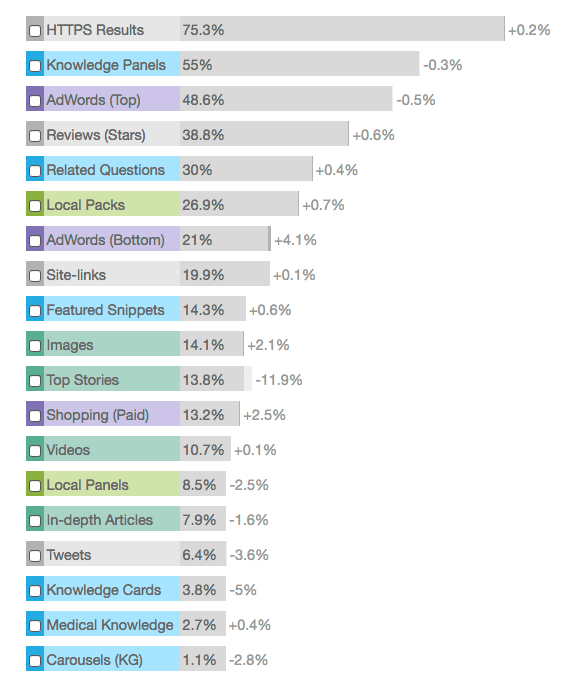

We recommend you review the effectiveness and efficiency of your approach of utilising different touchpoints through the customer journey to influence purchase. For example, some travel businesses may be exploiting the latest SEO techniques better and using the latest Moz features better (www.mozcast.com/features).

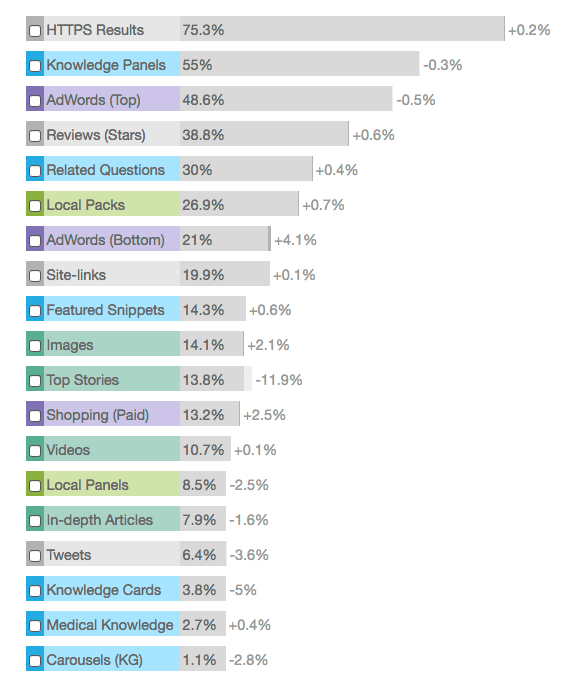

This is a snapshot of the latest features:

Most recent Moz features.

If your competitors are gaining visibility through related questions, or featured snippets, for example, then that is a missed opportunity. It may be publishers are doing well with in-depth articles, which gives opportunities for advertising or PR activities with them.

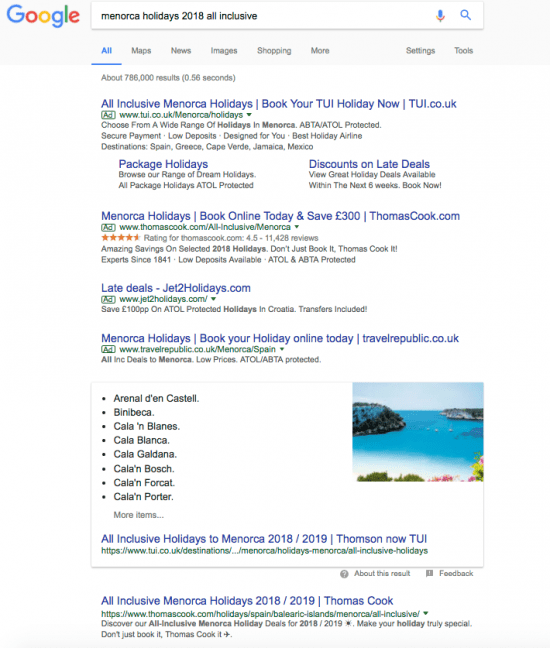

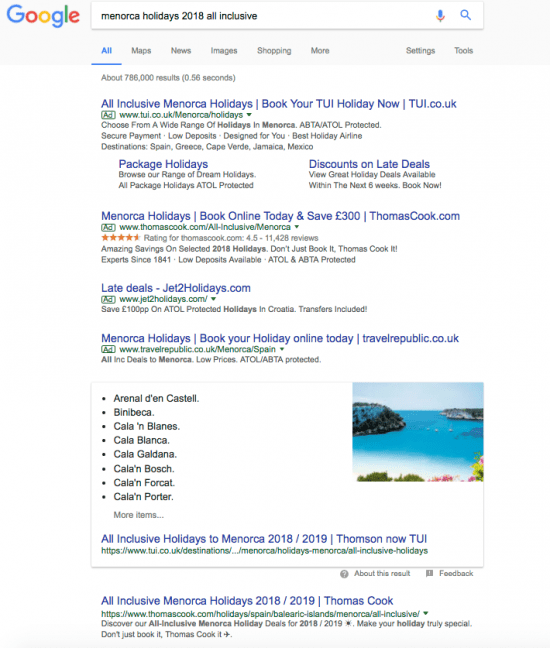

In this example, we see that TUI have good efficiency, with the top organic listing gaining more visibility through the use of a featured snippet and a page that matches the search term well.

"Menorca holidays 2018 all inclusive" search query showing featured snipped by TUI.com

Integrating a variety of channels into travel strategy can increase reach and conversion. However, what is sometimes missed in the travel sector is the retention of loyal customer. Providing an experience which is positive in all aspects will result in repeat purchase – they are unlikely to try a different airline or OTA if they have received the best possible deal, dynamic package, and feel a sense of safety with your agency. This will be looked at in more detail in a later section.

What influences travel bookings?

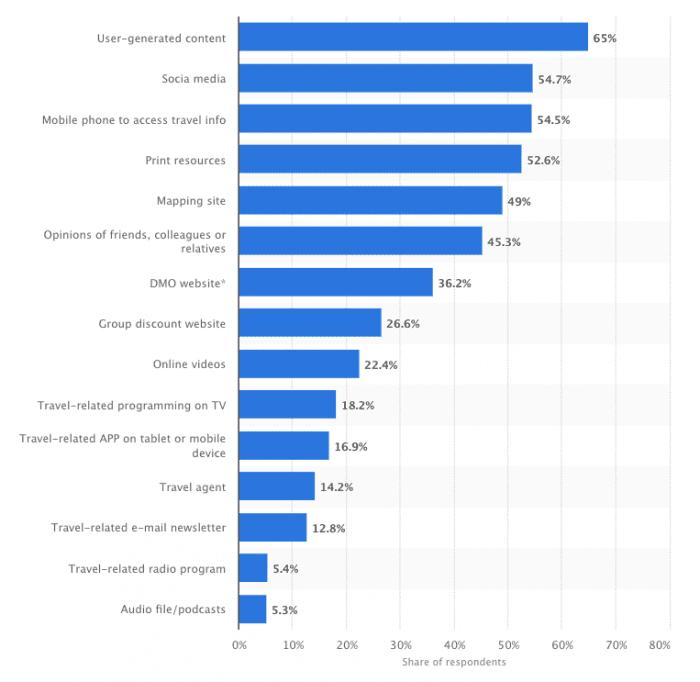

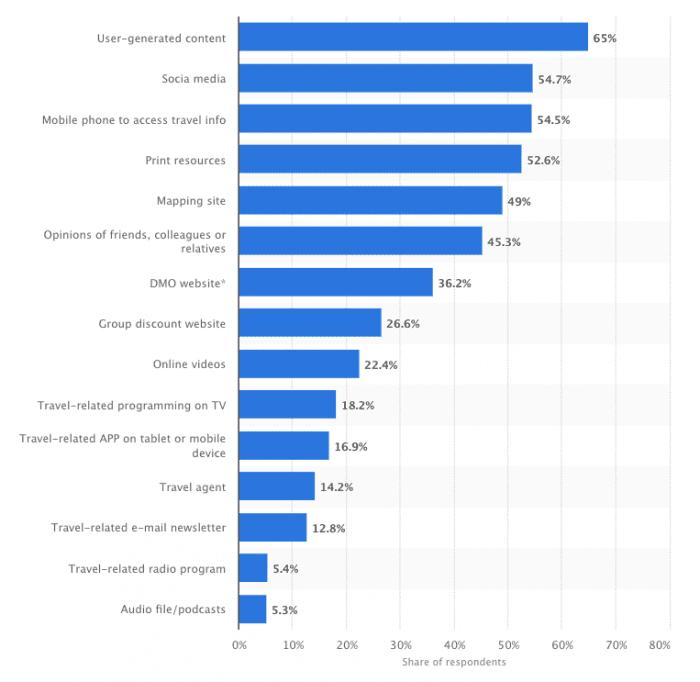

In recent research, published by Statista, it was found that the most popular tactic that travellers used to plan leisure travel was via user-generated content. 65% of respondents stated that in the past 12 months user-generated content had influenced their travel plans.

This can range from photographs and holiday reviews uploaded onto review sites, Google images and content on social media sites. The power of experience, reviews and visual proof of a ‘good time’ can be more persuasive than a strategically placed CTA, a last-minute deal or high-ranking SEO. This is why the rise of affiliate review sites and price comparison sites have gradually become popular year-over-year.

Influences to travellers to book holidays.

However, the percentage of people who also use social media (54.7%) and mobile phones to access information (54.5%) shows the importance of having a fully integrated multichannel marketing plan, which harnesses the power of marketing channels that travellers are using to research and book online. Collectively, this will lead to an optimized strategy that reaches potential customers at as many touch points as possible to create a positive brand awareness and encourage sales.

Driven by digitization, and consumer reliance on mobile devices, OTA’s continue to remain buoyant. For example, Expedia’s second-quarter gross bookings for 2016 grew by 25% YoY (year-over-year) to $18.8 billion. Its main OTA grew by 25% to $17.1 billion. However, in regions such as the US and Europe the online travel market appears to be maturing.

Market Realist claims online booking accounts for more than 40% of total travel sales. In most countries, online bookings are seeing healthy growth. The main market drivers for OTA companies are higher digitization, mobile adoption, and international expansion.

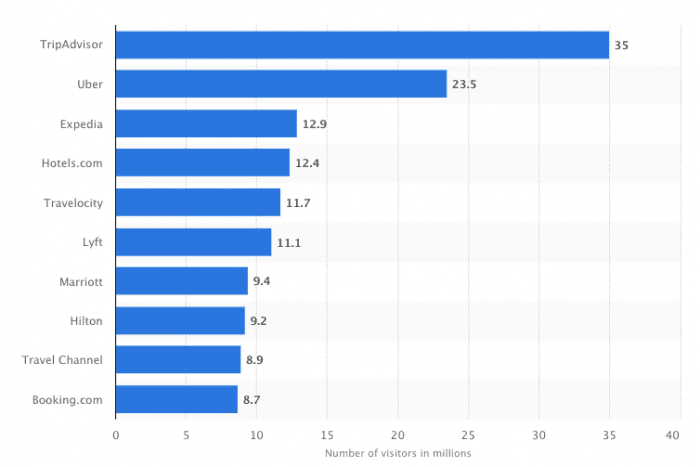

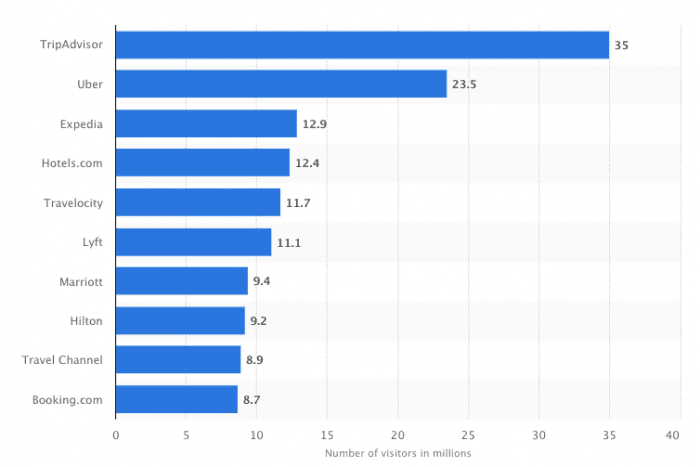

Most popular travel websites

TripAdvisor remains the most popular travel site in the United States as of April 2017. Research shows that TripAdvisor reaches 35 million monthly users. Second growing travel giant, Uber, with 23.5 million monthly users and then price comparison and booking site Expedia with 12.9 million monthly users.

Although some may protest that Uber’s place should not be compared to other OTAs it is important to note that they may not operate on an international travel basis but are fast becoming the number one domestic travel service. This highlights the rising importance of personal security and the principle of least effort.

Most popular travel website (April 2017)

Comparing this to last year’s research we find that travel ecommerce giants Uber and Expedia have not only placed in the most popular rankings but also outranked some other popular sites. Hotels.com remains a high preference, whilst AirB&B once in fourth position with 3.5% of market share visits has been bumped down by Travelocity and Lyft. This is not surprising since Expedia acquired Travelocity and Orbitz. Global travel accommodation sites such as Marriot and Hilton are still able to compete with OTAs and price comparison sites which shows a need for luxury, security and ease of booking.

Millennials

According to Forbes, millennials are the most important consumer generation for the travel industry because they place a great deal of importance on being unique and spontaneous and their culture identity is growing for exploration of the unknown. There is a growing need for dynamic packages that not only sell a holiday but create experiences and memories. This type of emotional rational is heightened by the lust and need for adventure. Millennials are more likely to spend more on a vacation – on average spending $1,312 on each vacation – an 8% increase from 2016 spending (Forbes).

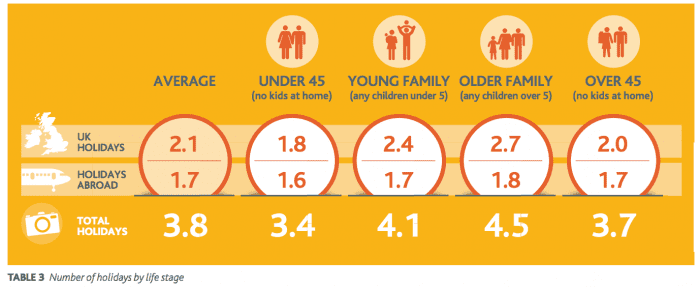

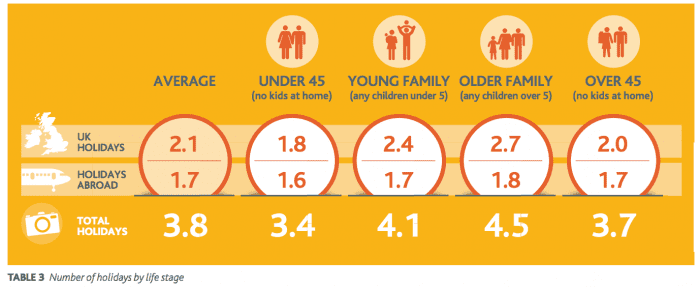

Other research by ABTA suggests that holidays are purchased by life stages and are not necessarily by age demographics.

Number of holidays by life stage.

Knowing how to market your products and services is important in targeting the right customer persona when creating copy on various channels. A hotel that appeals to a couple with no children will definitely not appeal to a family with children under 5 years old. Knowing who your target audience is and what they expect from their travels is just as important as knowing where and how they book. Make sure you’re targeting the right family, couple or solo traveller with the hotels and experiences you offer.

To find out more about travel industry trends, check out our travel ecommerce marketing trends 2018 - a comprehensive guide to help you benchmark your approach.