A record-breaking year for digital advertising as mobile and video dominate revenue in the US

The IAB’s internet advertising revenue report is a survey commissioned by the IAB and conducted independently by PricewaterhouseCoopers. It’s released in full twice a year and provides an overview of digital revenue performance and the influencing factors.

Although this report is from the US, many of the trends provide a strong indication of the direction digital advertising is taking in other western countries, including the UK. The 2018 report has revealed some interesting insights, most notably in relation to desktop vs. mobile, formats and market share by media.

Download our Individual Member Resource – Paid media and digital advertising playbook

This paid media planning guide will provide marketers with a structured approach to paid media planning to help exploit these opportunities while managing the risks.

Access the Paid media and digital advertising playbook

The report contains a lot of information so within this post I’m going to summarise some of the key headlines and insights and the implications for marketers.

Key growth drivers

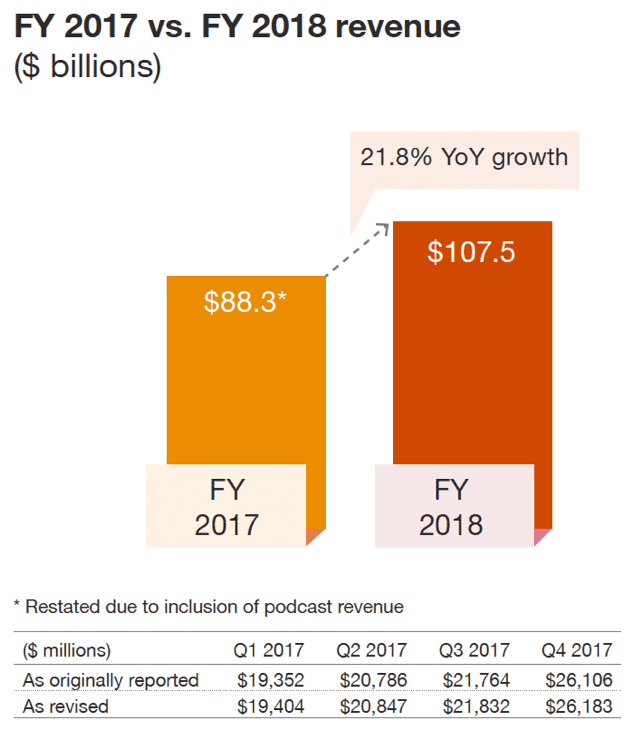

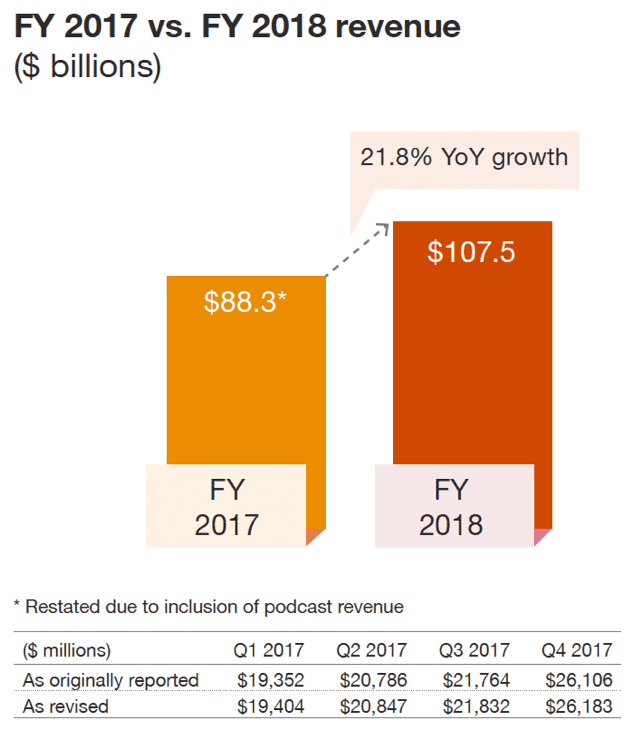

Digital revenues in 2018 surpassed $100 billion for the first time and described by Randall Rothenberg, President and CEO, IAB, as a "watershed moment for the digital advertising ecosystem".

The 21.8% year-on-year growth is strong and was driven by a number of factors, including:

The battle for market supremacy among new and established players

The digital advertising industry in the US is dominated by a handful of leading companies (Google and Facebook being the top two, although they are not referenced in the report). These digital ad giants gain strength by controlling the end-to-end purchase cycle, leveraging data, artificial intelligence (AI) and e-commerce.

Nevertheless, disruption in the industry is the norm and new entrants and smaller players are making moves to boost revenues by forming strategic partnerships.

The resurgence of e-commerce

E-commerce players have been adding new features to make it easier for advertisers to target audiences who are ready to convert searches in purchases. They have done this by combining data and AI to generate insights across the consumer journey, and using programmatic to reach audiences more effectively.

Storytelling catches fire

Led by social media, brand storytelling is a growing trend across platforms. Social media has given advertisers new and unique ways to engage with consumers through ‘social stories’. Consumers, especially Gen Z, are adopting social stories at a high rate and we may eventually reach a point where they surpass social feeds as the primary means in which consumers engage with advertising.

Introduction of GDPR/CCPA

Data-driven advertising has historically benefited from access to consumer data. However, new regulations, such as GDPR and the soon-to-be-enforced CCPA, are impacting growth rates, particularly for smaller companies who do not have the resource to invest in compliance. This will potentially precipitate a divide between smaller and larger players.

Programmatic advertising

Programmatic ad revenues currently account for 80% of all digital display advertising revenues in the US. Companies are benefiting from the cost efficiencies programmatic brings (e.g. ad buying, smart addressability) and walled gardens (closed ecosystems in which all operations are controlled by the ecosystem operator) have attracted small businesses to programmatic.

Innovation of new ad technology

Over the course of the last year, advertising platforms and publishers have innovated in their use of data and technology to improve advertising effectiveness. Artificial intelligence (AI) allows advertisers to harness data and deliver ads with higher precision (e.g. greater relevance, matched context, greater personalization) driving revenue per ad higher.

5G is also on the horizon and in the foreseeable future data will be processed and exchanged at incrementally higher speeds. 5G will enable advertisers to operate at higher efficiency, leading to developments in creative formats and an overall improvement in mobile video experiences.

Main headlines and insights

The full report provides detail on a variety of different areas that I would encourage you to read in full. However, for the purposes of this post I have highlighted some of the stand-out headlines and insights.

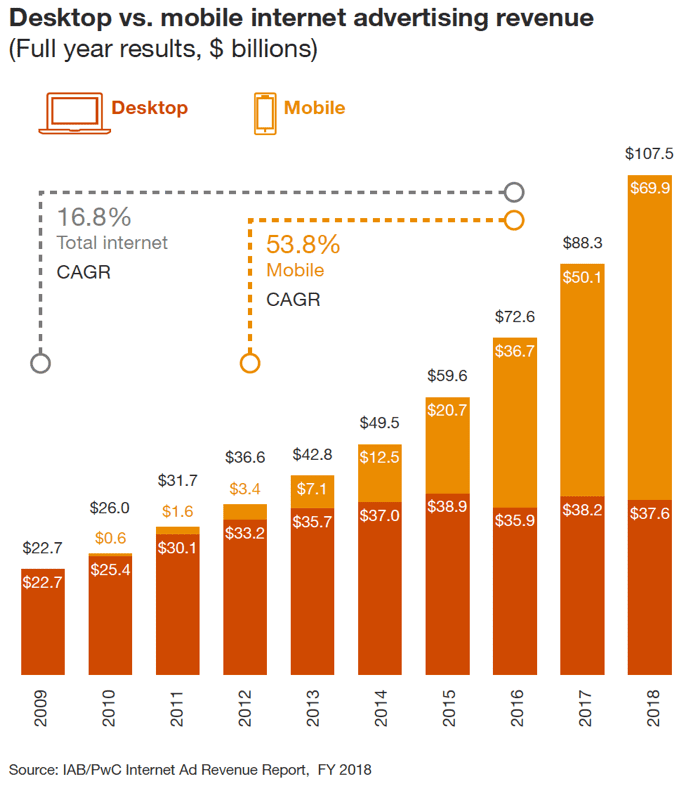

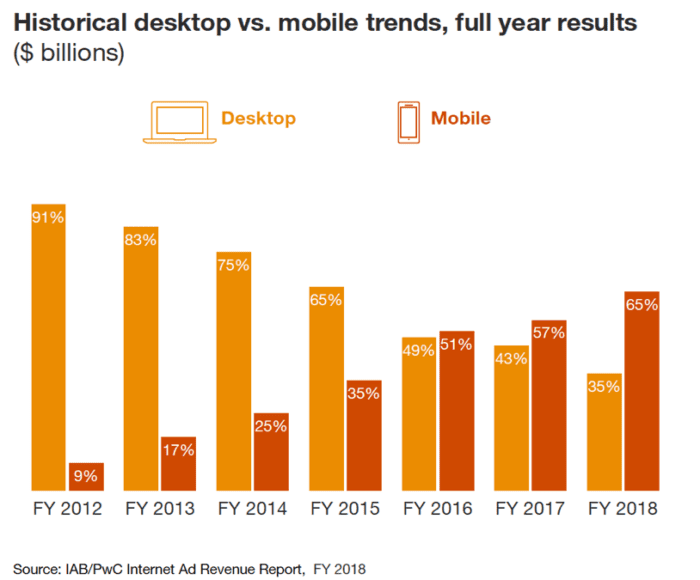

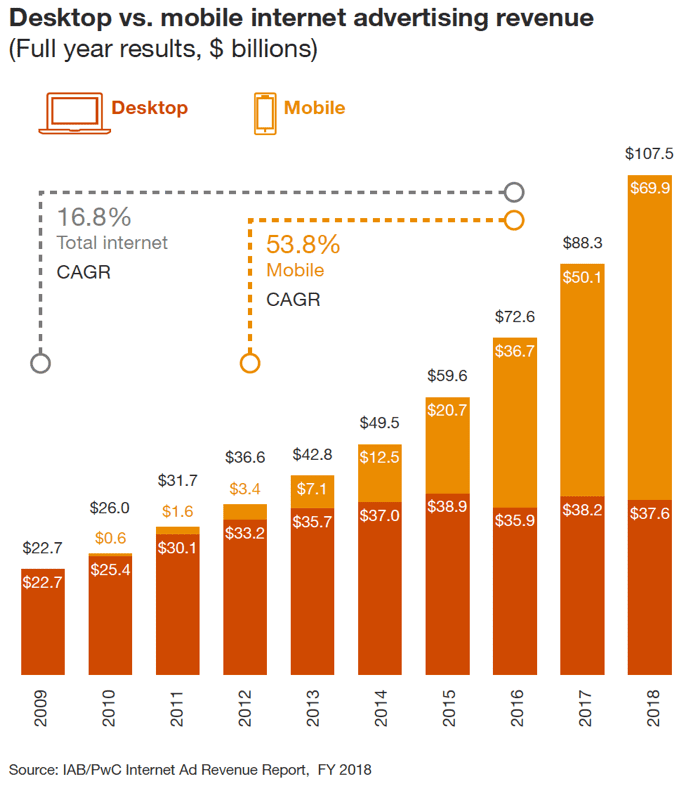

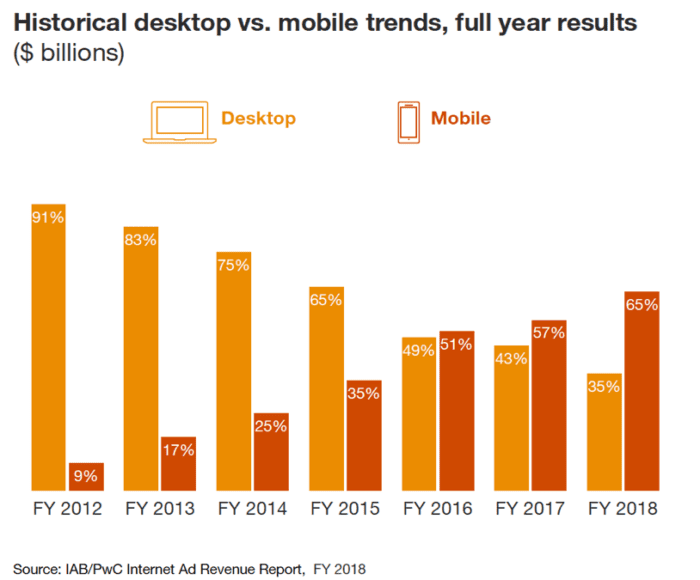

Mobile is now the leading device

Consumers are shifting their viewing behaviour and advertisers are following. Mobile internet advertising revenues are growing year-on-year (39.7%) and have benefited from advancements in single-click e-commerce, creative ad formats and social media placements.

Mobile has been steadily taking share from desktop and there is now a clear divide. We are likely to see very similar trends in the UK and it’s more critical than ever for marketers to create a mobile-first experience to reach and engage consumers successfully.

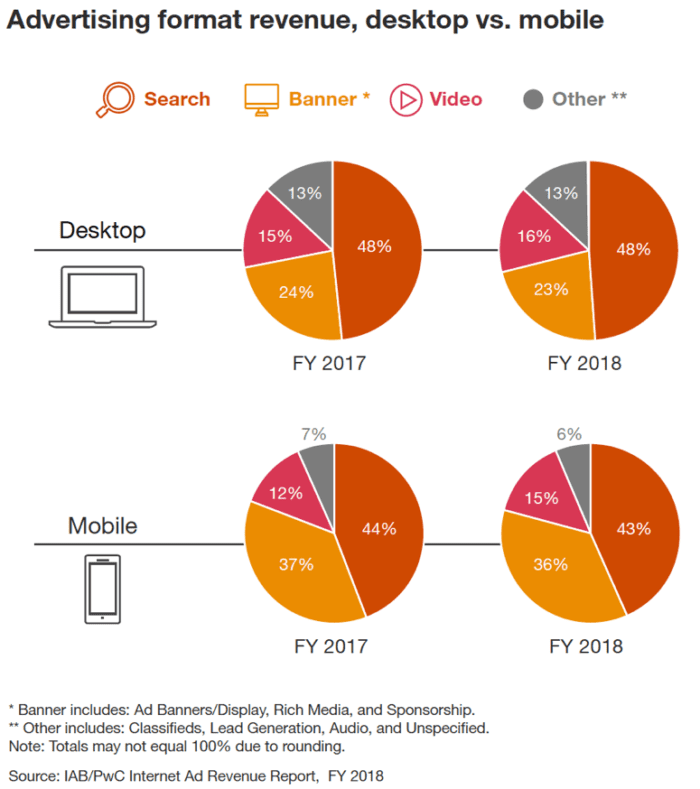

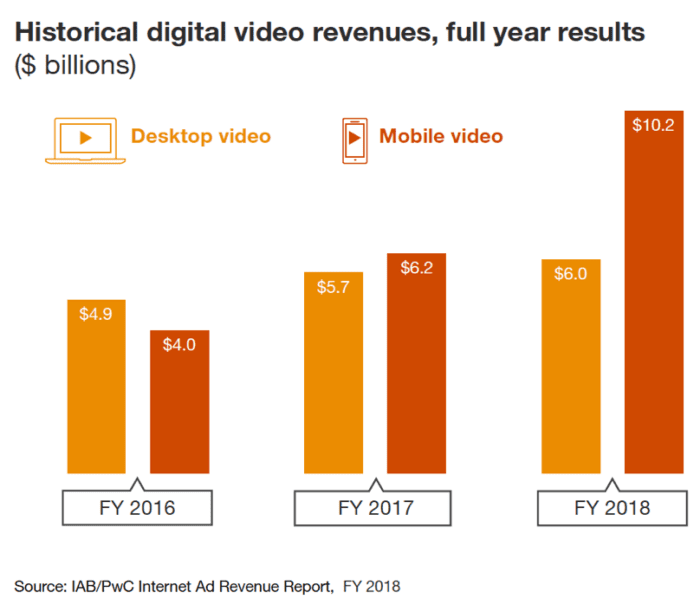

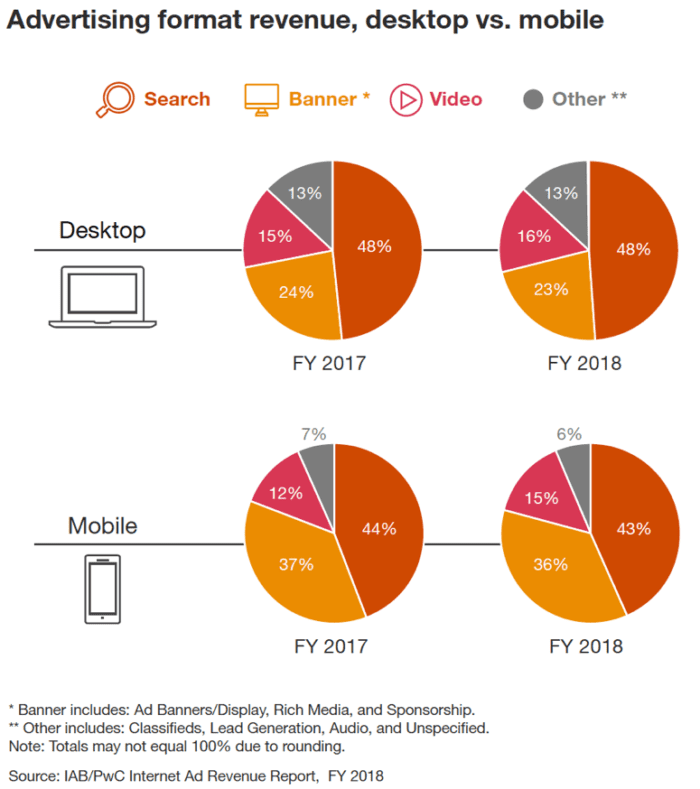

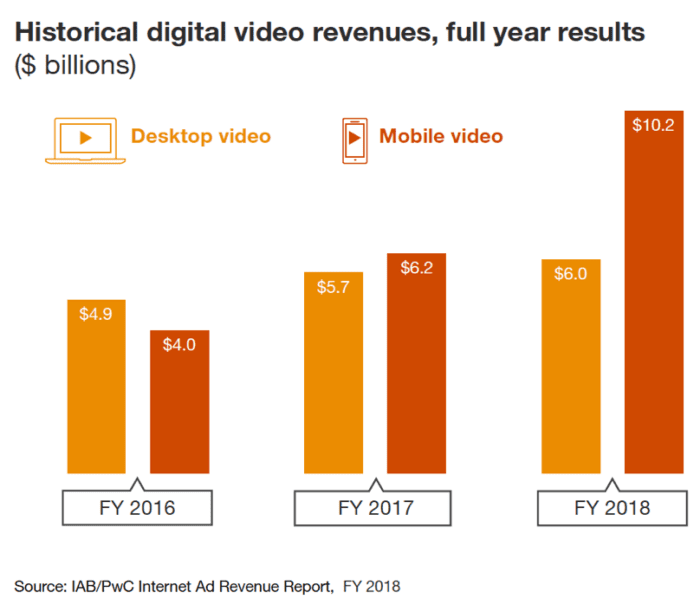

Video is now a growing ad format

Across both desktop and mobile video has outperformed all other formats, growing 6.6% and 65% year-on-year respectively.

Advancements in smartphone adoption and social media experiences mean that digital video dominance has strengthened the share of mobile and desktop growth in 2018. Short, snappy, brand-led video content is proving to be one of the most effective ways to reach and engage audiences across multiple platforms.

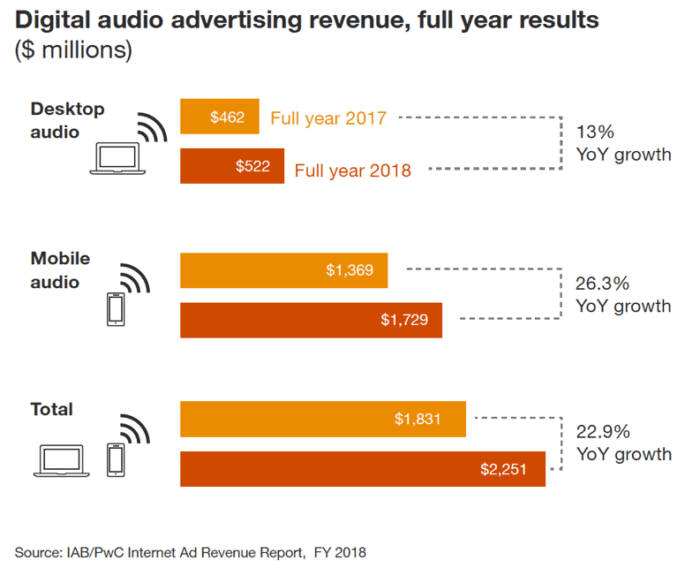

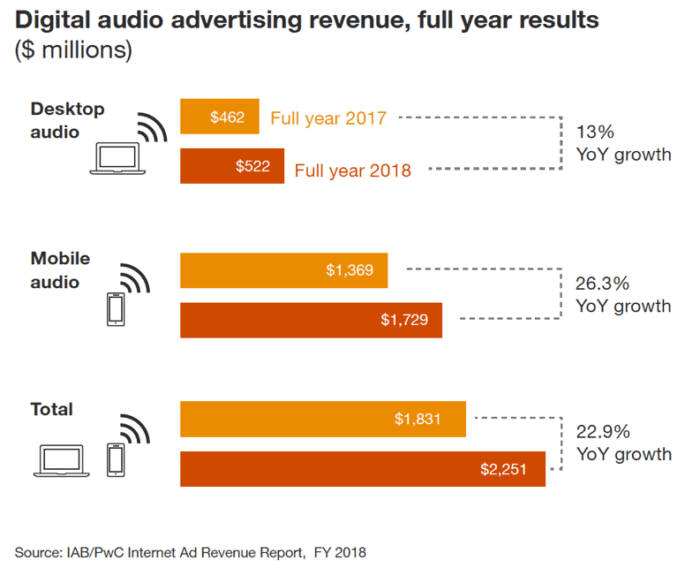

Digital audio is on the rise

Although digital audio advertising represented only a 2.1% share of the total internet advertising revenue pie in 2018, it grew 22.9% year-on-year and reached $2.3 billion. The majority of the growth came from podcast advertising revenues and it’s now clear that this channel has reached mainstream adoption.

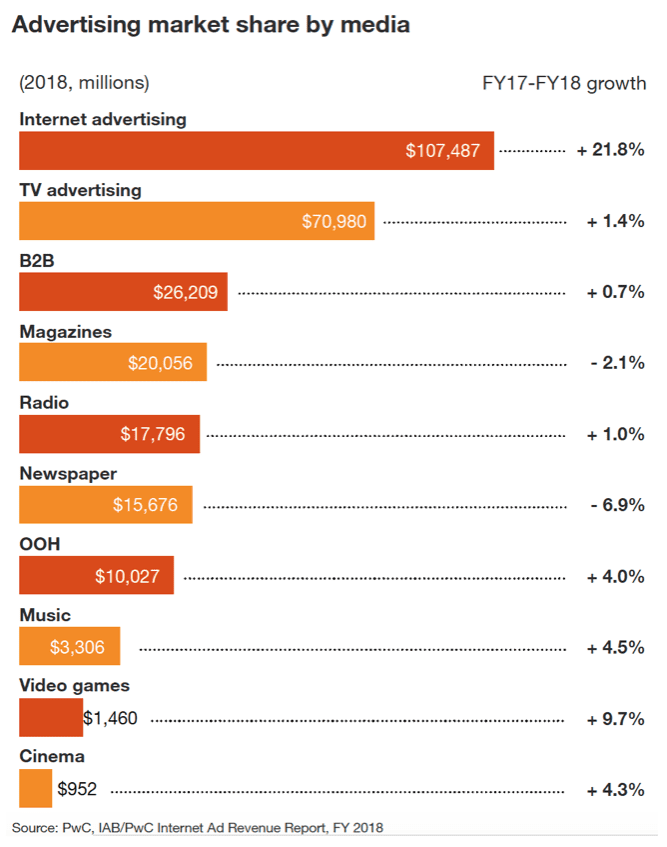

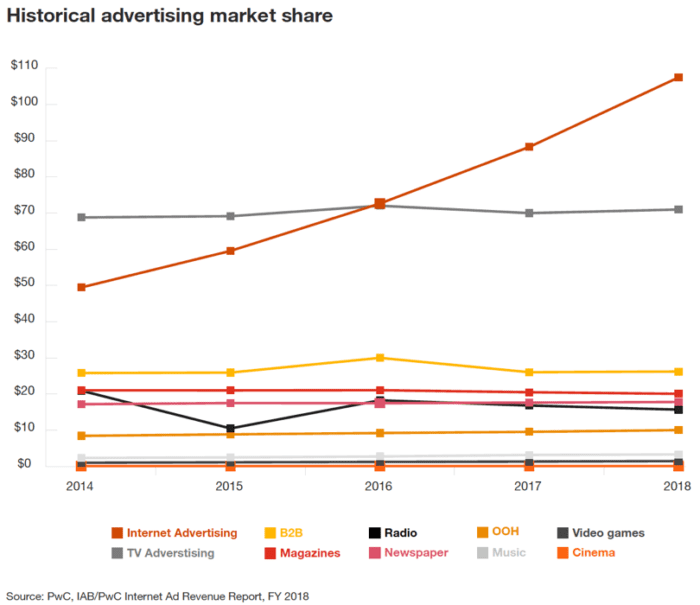

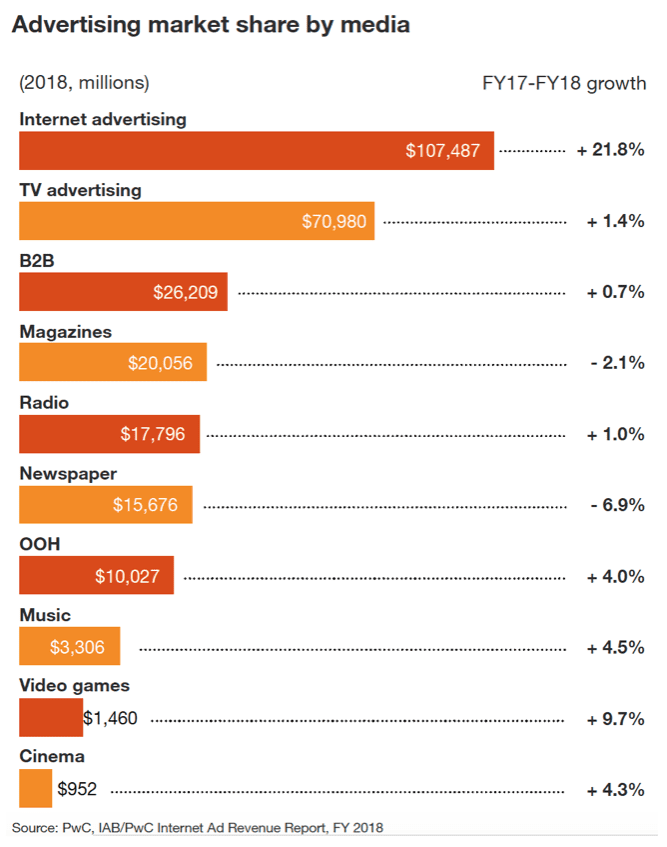

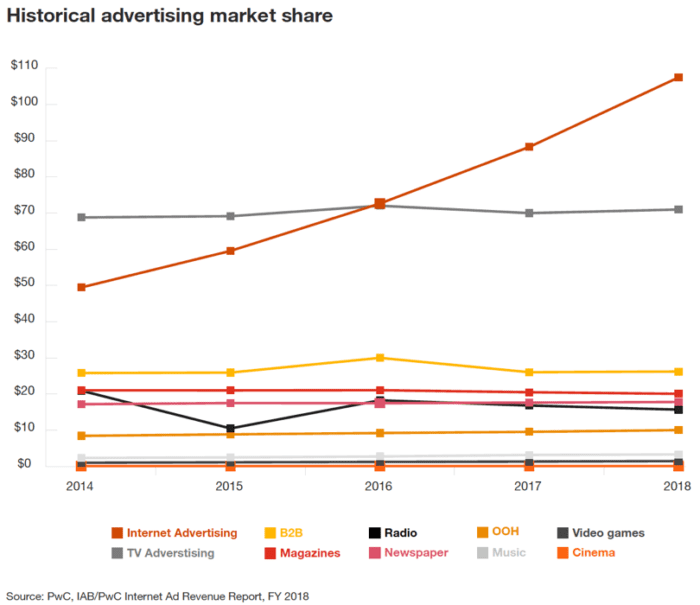

Internet advertising continues to build advertising market share

Internet advertising passed the $100 billion mark for the first time in history and now leads TV advertising by over $36 billion.

Established media channels, such as TV, are very far from dead and work for certain types of brands. But no other media type except digital experienced double-digit growth year-on-year, driven largely by the innovation and accessibility across many different channels.

Conclusion

The IAB report highlights a range of insights that marketers should consider when compiling their media and content plans. Two key growth drivers - the resurgence of e-commerce and emergence of social storytelling - indicate that digital advertising is not only growing but evolving in line with changing consumer behaviour, and this presents new and interesting opportunities for brands.

The continued growth in mobile and video is the consequence of advancing technology and improved formats on smaller screens. The advice to plan with mobile in mind has never been more important and it’s therefore crucial that marketers think about how to present their brands on different types of screens and sizes.