Content marketing best practices and examples for financial services

It’s important to review how content can be used effectively in your specific sector. In this article I will review content marketing approaches for financial services, a sector I'm involved with.

Each industry sector has its own unique traits and idiosyncrasies and financial services is certainly no different. In fact, due to the complex nature of many financial products, the challenges of creating engaging content and an increased focus on compliance and regulation, one can argue that content marketing for financial services companies is a particularly tricky discipline to master.

Nevertheless, despite the challenges that exist within financial services there are also considerable opportunities that content marketing can exploit if planned and executed effectively.

I would suggest that the steps for establishing a content marketing process is very much the same as it is for any other business but with a few exceptions in certain areas to support, and make the most of, the particular characteristics of a financial services organisation.

Start with strategy and planning

As a financial services organisation, it’s important to be clear from the outset as to how content and content marketing can and should be used at your business. Whilst there will always be an opportunity to be bold and imaginative, you’ll need to assess your company's appetite for ‘risk’ and what you may/ may not be prepared to do. Start by answering the following questions:

- What is content? And what does ‘content marketing’ mean to us?

- Who is our audience?

- What are our competitors doing?

- How can content support our business and marketing goals?

- How can content be integrated into other areas of marketing and the wider business?

- How will content be sourced, managed and created?

- How will content marketing efforts be measured?

One of the important, early steps in the content marketing process is to build a business case for investment. This will help not only help gain budget but also buy-in from various teams and departments from across the company.

Read the Smart Insights' Content Marketing Toolkit for more guidance on managing content marketing - the guide by James Carson is aimed at helping answer these questions.

Benefits of content marketing for financial services

The obvious, stand-out benefits of content marketing for financial services is consistent with the wider market and include:

- Builds brand awareness and craft your brand ‘story’

- Drives positive results from organic search rankings and traffic

- Fuels social media marketing efforts

- Supports advertising, PR and outreach

- Drives purchases

Begin crafting an outline framework for your content marketing strategy:

- 1. Set your core goals and objectives

- 2. Conduct a competitor analysis of direct and indirect competitors

- 3. Define your audience and target markets

- 4. Integration

- 5. Policies and guidelines*

- 6. Content calendar

* This will be particularly important for reputation management and compliance purposes.

Content calendar

Once you’ve defined a clear strategy and formed an agreement on how content will be used to support your wider marketing and business goals, it’s time to begin creating your content calendar.

Map out broad themes

Start by considering the key financial trends throughout the year. As a rough guide, this could look like:

- January - February - debt consolidation; winter holidays

- March - April - ISA season; spring and Easter holidays

- May - July - home improvements; wedding season; summer holidays

- August - September - New car purchases; back to school/ university work

- October - December - Christmas planning and spending

Drill down into the detail

By outlining the broad trends for the year, you can then start to drill down into more detail and define the various topics for each week and month of the year.

For example, for the month of January this could look like:

January:

Week 1:

- New years resolutions - building better money habits

- Pay off your debts vs. saving

Week 2:

- What did the nation bought this Christmas?

- How to improve your credit score

Week 3:

- Best ways to manage your finances

- Insuring against a cold snap

Week 4:

- Money saving advice for winter breaks

- Winter travel tips

Decide on the most appropriate content types

Once you have a good idea of the main themes and topics, it’s time to begin thinking about the types of content to be used.

It’s important to remember that the medium itself should never take the lead. For example, there’s been a wayward obsession with infographics for the past few years, with the flawed assumption that an infographic in itself will drive interest and engagement

What gets attention is the combination of great data, design and story. An infographic may not always be the most effective type of content for the theme or topic you’re trying to talk about. It may instead be a video, article, case study or guide, so all option should be considered.

The key is to consider the message and target audience it’s aimed at and choose the most appropriate type of content to connect with them. Some of the most popular types of content for financial services include:

- Written articles and blog posts

- Tools and calculators

- Videos

- Guides and e-books

- Infographics and data visualisations

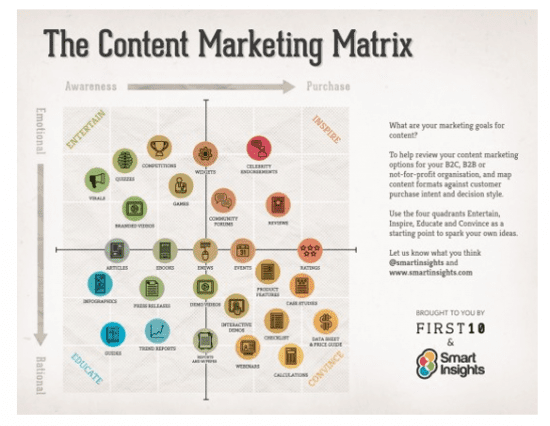

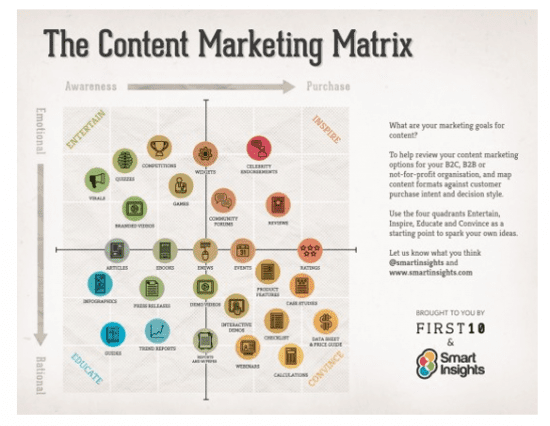

The Smart Insights Content Matrix offers an excellent tool for generating content ideas based on:

1. Where your target audience is in the user journey

2. What are you trying to achieve as a business

Build your content hub

So, with all the new content you’re producing, where is it going to go?

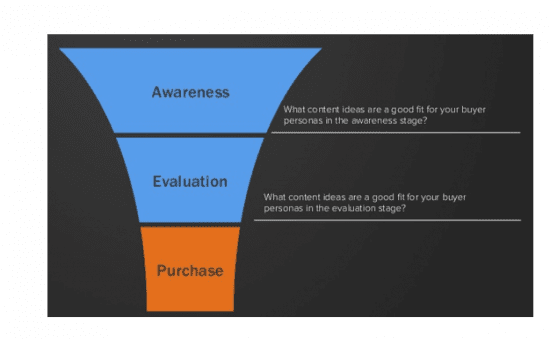

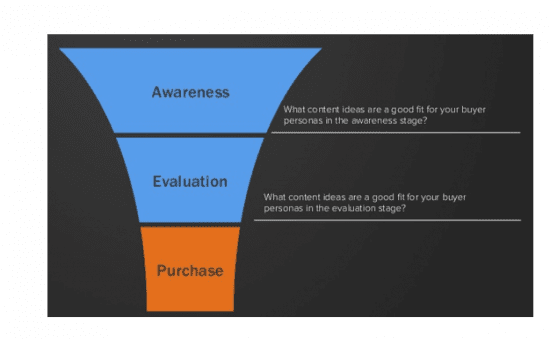

When we consider the traditional marketing funnel, we can see that users/ buyers are likely to be in one of three different stages:

This means that content can be used across your website, as well at outposts, for example social media sites and blogs, depending on what stage the customer is likely to be in and the objective of the piece of content.

However, as a starting point I would always advocate the creation of a central, branded content hub within your website. This is a place where your audience can access and interact with your content and where you can integrate, syndicate and distribute the content to other areas of your website and beyond.

What can a content hub include?

A content hub can take on any number of different guides, including:

- An online news section

- A blog

- A digital customer magazine

- A resource centre

As a financial services organisation, it’s important to consider carefully the type of content hub you use. As with the individual pieces of content, your audience and objectives should lead your decision.

A number of different financial services organisations have approached the concept in a range of different, imaginative ways:

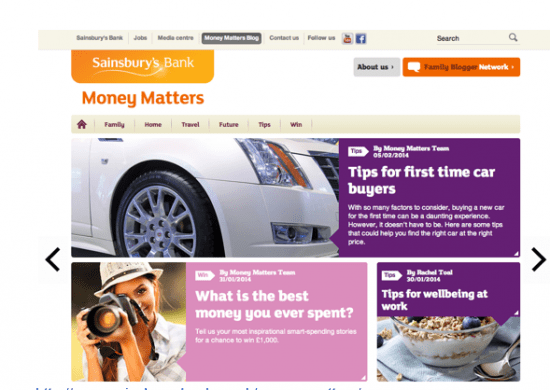

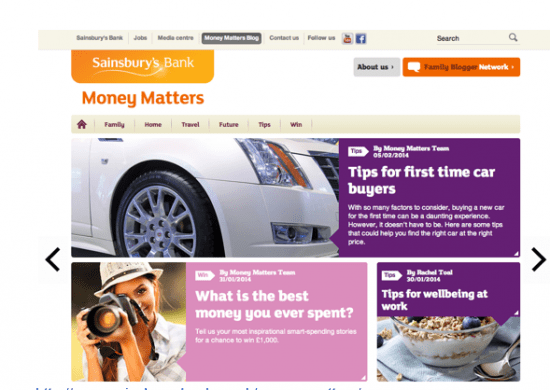

Case study - Sainsbury’s Money Matters

Source: Sainsbury's Money Matters

Sainsbury’s have created a blog within their website with content providing tips, ideas and information on a range of relevant topics.

Key features:

- Content is broken into six main categories to help users easily navigate to the most relevant content: Family, Home, Travel, Future, Tips and Competitions.

- There is a range of content types, including articles, tools and data visualisations/infographics to help bring information to life.

- Sainsbury’s have created a ‘Family Blogger Network’, enabling guest bloggers and writers to post content on Money Matters and generate both exposure for themselves and great content for Sainsbury’s Bank.

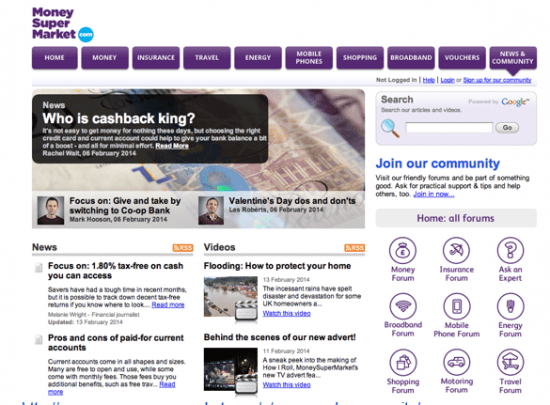

Case study - MoneySuperMarket’s News and Community

Source: Moneysupermarket

MoneySuperMarket have developed a vast news and community section with hundreds of articles, videos and podcasts on a diverse range of topics.

Key features:

- Content is divided into a number of different areas, including News, Videos, Popular, Editor’s Choice and Press Releases. There is also a regular ‘Focus On’ section which MoneySuperMarket uses to take a look at a particular product or feature, for example a balance transfer deal or mortgage rate.

- The content on the ‘news and Community’ section is geared towards seasonality. For example from February to April there’s a clear focus on ISAs.

- Every article has a date, category and author associated with it and MoneySuperMarket have ensured that each author has a Google+ profile, enabling them to use Google’s authorship mark-up and enhance their present within organic search results.

Managing compliance considerations

As alluded to earlier in the post, compliance and regulatory concerns are an important consideration for all financial services marketing, which includes organic and paid search, social media and content marketing.

Financial Conduct Authority

Every financial organisation will manage compliance in a different way and some may be stricter than others in their observation and interpretations of the guidance provided by the regulatory bodies. In the UK, the Financial Conduct Authority (FCA) regulates financial firms providing services to consumers, with their remit focused on maintaining the integrity of the UK’s financial markets and ensure that financial products and services meet consumers’ needs.

One of the potential stumbling blocks for many content marketers in financial services will be around the concept of financial promotions. This is defined by the FCA as:'An invitation or inducement to engage in investment activity'.

Whilst most content marketing activity may not be seen as a ‘financial promotion’ by the marketer, it’s important to understand and abide by the FCA’s definition of a ‘financial promotion’ and ensure that content is:

- Stand-alone compliant - where a reference to a rate or deal is quoted, for example, you cannot expect the consumer to click a link to find out more information. This has to be clearly stated and referenced within the same web space or page.

- Risk warnings are prominent- this might sometimes mean that the risk (e.g. 'Your home may be repossessed if you do not keep up repayments on your mortgage'is as clear and prominent as any promotional message this relates to.

- Not misleading- that messages are not false, overly ambiguous and relevant for the target market.

As part of any content production process, it’s therefore wise to keep the in-house or outsourced compliance team for your organisation on-side and give them the ability to review and feedback at various stages of the process. Whilst it may not be preferable to have compliance involved at the brainstorming stage, for example, it is recommended that compliance have sight of content:

- Once initial ideas and topics have been decided to ensure that nothing causing a serious breach is being proposed.

- Following input from wider stakeholder groups, e.g. product marketing, PR, social media and SEO and as a final sign-off prior to going live.