Part 1. Using web analytics to benchmark website performance and drive insight through data

This is the first in a 12 part series on website optimisation to boost natural search traffic. The series started in 2011 and will continue into 2012. We're featuring it as a part of a series of posts about optimising marketing in 2012. You can see all my posts in the series here.

I hope these articles will provide you with a solid framework to review and improve your current approaches to SEO or to apply SEO to a new site. I've discussed this advice with Dave Chaffey and Dan Barker who write for Smart Insights too, so I'd like to thank them for their input.

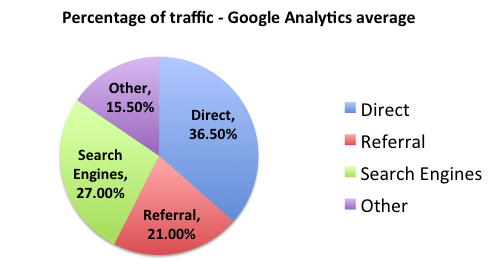

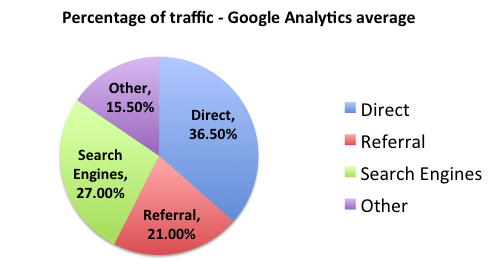

As this data on site visitor traffic sources shows, search engines are still one of the major drivers of visitor traffic to sites, so there's good potential for driving more visitors from this source - on many sites I've worked on the figure has approached 50% or higher.

In the series I'll use both ‘natural search’ and ‘organic search’ to refer to visitors from search engines and the terms ‘SEO’ and ‘website optimisation’ to refer to the process of improving your web presence to drive and convert traffic from natural search. Since I often work on Ecommerce sites, later articles will focus more on this, but the steps in this articles can be applied to any site.

I'm a great believer in using web analytics to improve SEO, so each article will show you which measures, reports and techniques in Google Analytics can help.

When I work on SEO, the first stage is always to use web analytics to understand your current performance and establish a set of benchmark data against which to compare future performance. In this first article I'll look at 6 different types of data that can be used to improve performance.

Data Set 1: Top-level KPIs

Let’s take it from the top down. Top-level KPIs comprise the data and reports that are usually circulated to senior management and across the company to update on website performance. See the table below for data I recommend to my clients and the source of the related report in GA. This is based on a weekly reporting cycle.

Reviewing this article with Dave Chaffey, we agreed that it's useful to provide a business context by grouping KPIs. Grouping by Volume, Value and Quality is a good approach - so often it's just the volume measures that are reported.

| KPI Group |

Measurement |

Value |

| Volume |

Natural search traffic volume |

Useful in trend analysis and internal reporting |

| Natural search traffic as % of total traffic |

Pinpoints how important natural search is relative to other traffic sources |

| % split between Branded and Non-branded traffic |

Illustrates how dependent you are on brand traffic |

| % split between New and Returning visitors |

Shows how effective your SEO is at customer acquisition and retention |

| New registrations via natural search |

Demonstrates the non-financial benefits of SEO |

| New email sign-ups via natural search |

| Content sharing from natural search visits |

Shows social impact of content |

| Change in traffic v last week |

Useful in trend analysis and internal reporting |

| Change in traffic v same period previous year |

Useful in like-for-like comparisons and macro market analysis |

| Value |

Natural search revenue |

Useful in trend analysis and internal reporting |

| Natural search revenue as % of total revenue |

Pinpoints how important natural search is relative to other traffic sources |

| Revenue per visit v other media channels |

Enables an evaluation of the relative value of each visit in comparison with other marketing channels |

| Natural search AOV (Average Order Value) |

Pinpoints how important natural search is relative to other traffic sources |

| Change in AOV v last week |

Useful in trend analysis and internal reporting |

| Change in AOV v same period previous year |

Useful in like-for-like comparisons and macro market analysis |

| Quality |

Natural search conversion rate |

Useful in trend analysis and internal reporting |

| Natural search conversion rate (bounces filtered) |

Helps identify how effective your website is at converting visitors who make it past the first click – gives a better picture of engagement |

| Change in conversion v same period previous year |

Useful in like-for-like comparisons and macro market analysis |

| Bounce rate |

Build picture of engagement by showing how SEO traffic behaves once it hits the website |

| Average time on site |

| Pages per visit |

To filter bounces

This can be done via Advanced Segments for the E-commerce conversion rate report following these steps:

- Open up the GA profile.

- Go to 'Ecommerce' in the left nav

- Go to 'conversion rate' within that

- Toward the top-right of the screen, you'll see a little area that says "Advanced Segments: 'All Visits'". Click on that

- Under 'Default Segments', uncheck 'All visits'

- Check 'Non-bounce visits' (should be the last one on the list)

- Hit 'Apply'.

- You should now be looking at the conversion rate report filtered to show only visits that didn't bounce.

I recommended maintaining this data in a convenient format such as an Excel spreadsheet where you can add data weekly and generate charts to visualise trends. Dashboards should also be set-up in GA to automate reports.

Chart 1 – Website Conversion Rate Year-on-Year comparison

Excel chart for SEO KPIs

Charts like this are insightful when you overlay contextual information such as the dates of marketing campaigns and external events, such as seasonal markers like Easter that vary from year to year. GA now enables notes to be added to reports for this purpose. With the recent Google change to the definition of a 'visit', its worthwhile putting this date as a marker in GA as you may experience some short-term data anomalies.

Please be aware that top-level KPIs provide only a surface layer of information for SEO and are useful primarily for trend analysis and flagging important fluctuations. They don’t provide the detail with which to evaluate the success of your SEO program; for this you need to add layers of detail. We will explore some of this detail below.

Data Set 2: Natural search v other marketing channels

The next level of data is a comparison with other marketing channels. This helps you identify how natural search traffic performs compared with other traffic sources.

As a minimum, compare natural search with paid search (PPC), email, affiliate (referral) and social media traffic. This will help you build a picture of the effectiveness of natural search traffic compared with your other core digital marketing channels.

You will gain greater insight in GA if you establish goals and assign goal values to each goal. This will enable a direct comparison of the contribution of each marketing channel to goal completion. For example, newsletter sign-up may not deliver direct revenue but you can calculate the financial value of an email address based on the average revenue per email you generate from campaigns. Adding this layer of detail helps build a clearer picture of how natural search traffic contributes to your business.

The most important KPIs for this are:

- Volume – total volume of visits from natural search v other marketing channels

- Value – conversion rate for natural search v other marketing channels & revenue per visit

- Quality – site engagement (bounce rate, time on site, pages per visit) v other marketing channels

Data Set 3: Customer engagement

Your KPIs tell you that natural search traffic conversion is 2x higher than the website average and SEO generates 40% of total traffic. That’s great right? Or is it?

To determine how effective your website is at converting natural search traffic, you need data that reveals customer engagement. Engagement is not just about conversion, it also relates to how well your website maintains visitor interest and how it leads to repeat visits and the sharing of your content. To evaluate this you need to interrogate the following information:

- % new v repeat visits

- Time on site

- Number of visits before conversion

- Bounce rate

- Exit ratio

- Per visit value

- Content bookmarking

This data doesn’t sit conveniently in a ready-made report. You need to compile data from different reports to generate a broad view.

Measuring the extent of content sharing from organic search traffic (e.g. social bookmarking of your webpages) and how this leads to future visits and revenue, is a more complicated challenge. Avinash Kaushik wrote a good post on web analytics solutions on his Occam’s Razor blog that reviews a few tools that can help.

Data Set 4: Keyword performance

Here we get to the nuts and bolts of SEO. Before you get excited about keyword research, you need to know what keywords and phrases are already driving traffic to your website and how they affect your KPIs. This will enable you to analyse how the keyword set that drives the majority of your organic search traffic evolves over time; usually, you’ll find a core set of keywords and phrases that are consistent performers and you can focus optimisation efforts around these bankers instead of sacrificing resource to transient keywords.

You might consider breaking this down into a manageable chunk:

- Identify the top 100 keyword and phrases based on traffic volumes

- Compare engagement metrics for these keywords and phrases

- Maintain this data in a spreadsheet to enable trend analysis (e.g. If one keyword phrase suddenly starts pushing large volumes of traffic but has poor conversion, it’s a red flag for action)

To access this data, take the following steps in GA:

- Click on Traffic Sources in the left hand menu

- Click on Keywords

- Under the graph on the left hand side click on Show: non-paid

Google Analytics non-paid keywords report

If you’re running a large website it’s realistic you’ll have thousands of keywords generating traffic. To monitor each one is time consuming and rarely justifiable when you look at the relative benefits.

It’s prudent to focus on keywords and phrases that drive traffic. Optimising your website to improve conversion for a keyword that has 1 visit per year is only commercially viable if that conversion means £big. For most retailers, the focus is on the large volume keywords with low engagement where marginal improvement can drive significant ROI.

I’ll explore the art of keyword research in a future post. Below is an example from a bespoke report I created for a retail Client.

Compiled date for natural search engagement

Data Set 5: Branded v Generic search traffic

Taking your natural search traffic as a homogenous data set isn’t a great idea. It’s inevitable (though happy to be proved wrong!) that branded traffic will outperform generic traffic for engagement and conversion.

Visitors entering via brand terms already know your brand, therefore represent better-qualified prospects. Generic traffic usually drives a less brand-loyal visitor, even though they might be at an advanced stage of the buying cycle. The value of this analysis is in understanding how generic traffic is affecting your overall SEO KPIs. The focus for most web owners is on creating and optimising content to grab traffic for relevant generic keywords, then improving conversion from the search tail.

Firstly, set-up your reporting suite to split branded and generic natural search traffic. Below is an example of the data that is useful for this comparison. You can then micro-manage this data at keyword level.

The table below is taken from a report I did for a Client, with cells highlighted to identify interesting data that demanded further interrogation and action. I often find it easier to export the raw data and manipulate in Excel. You can take this one step further and split brand and generic traffic between new and returning visitors. To enable this, use the Advanced Segments functionality in GA. Please note that the data below doesn’t exist like this in GA; it required the export of report data into Excel and some gentle manipulation. But don’t worry, if I can do it anyone can.

Compiled data reports using GA data

Dave wrote a post in 2010 over on SEOOptimise on the use of advanced segments in the previous version of GA.

Data Set 6: Interaction between short, medium & long tail

I love this data. Too many companies base planning decisions on the immediate conversion of a keyword or phrase. However, search isn’t so prescriptive. Some visitors will find your website using a short tail search term as they start their buying cycle. Only a small % will convert from that first visit, so exits aren’t always lost causes; often people spend time researching solution options and perform additional searches for more specific keyword phrases. It’s a commercial necessity to correlate the impact of short-tail traffic with the conversion from long-tail traffic as well as the attribution effect of a keyword phrase on a future conversion.

For more info on using GA to set-up advanced segments for long tail search, take a peek at Dave’s post on the Smart Insights blog on Google’s Mayday Update.

Below is an excerpt from a report I did for an electronics retailer. This data was taken from Channel Advisor, a 3rd party reporting tool. I’m not aware of being able to compile this data in GA though would welcome suggestions.

Channel Advisor report for search attribution

If you’re new to this terminology, here's a chart (adapted from the original from the helpful people at Econsultancy) to help visualise the tail of search:

Search tail

Your thoughts, comments and personal experience

I’ve deliberately left lifetime value from this post because each Client I work with has a different definition of lifetime value. Furthermore, how do you attribute sales that have the last click in other marketing channels, such as email, when the first click came from natural search? Or vice-versa. Some companies ignore this attribution effect and focus on last click analysis for ROI, others attribute a % of the final sale to the channel that generated the initial contact.

It is, therefore, very hard to cherry pick one report upon which to base the lifetime value analysis. It’s also not possible directly within GA without exporting data and marrying up to individuals, which is against the ToS. The latest version of GA does have multi-channel funnels though this is on limited release.

So this is step 1 in the Smart Insights 12 step series of website optimisation for natural search. It’s by no means an exhaustive list, more a steer in the right direction. Please join in the discussion with comments and your own experience of benchmarking performance. Keep an eye out for next month’s article, “Delivering competitor analysis for SEO”.

Thanks

james