Consumer online shopping behaviours: How do Consumers select a supplier?

Following on from our first post summarising the 'UK Consumer Empower Survey Report' from the BIS, we are extending its findings in this second post to share how the UK population choose a supplier when purchasing an item over £100 and how they search for information.

We're highlighting this research since it's a high quality piece of research commissioned by the UK government and surveyed by GfK NOP based on a quantitative survey amongst a representative sample of the UK population (6,024 interviews were conducted with adults aged 16+). It covers a range of sectors relevant to Smart Insights members including: purchases (Furniture, home furnishings or building materials, Computers, Home electronics, Car, van, motorbike) and services (Electricity, Internet, Mobile phone network, Car insurance and Bank accounts.

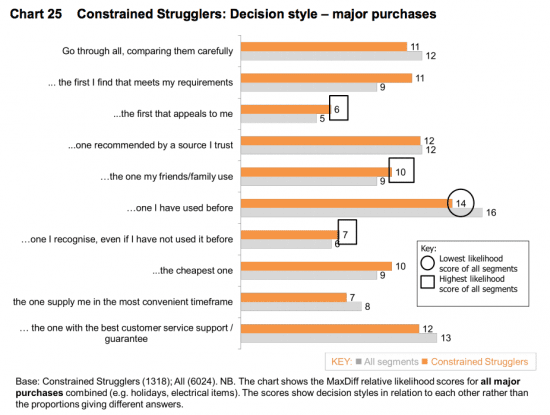

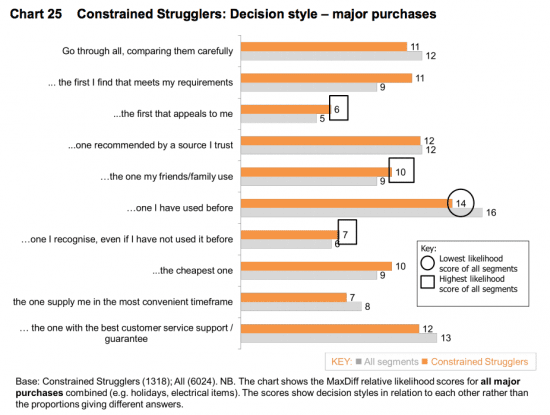

The research reviews decision making for purchase amongst 5 consumer segments introduced in our previous post. For example, these findings compare how the 'Constrained Strugglers' differ from the average.

Here is a reminder of the definition of the 'Constrained Struggler':

Less empowered group with an average age of 45 years and highest mix of ethnic background. Tend to be classified as DE social grades, lower qualifications and less savvy at managing their household bills and day-to-day commitments. As a consumer, tend to feel ill-at-ease with purchases, not likely to research for deals or negotiate with companies.

So what's important in the decision-making process?

The 'Constrained Struggler' who are vulnerable and less motivated to research, will be inclined to choose the first provider which may not be a company they have used before.

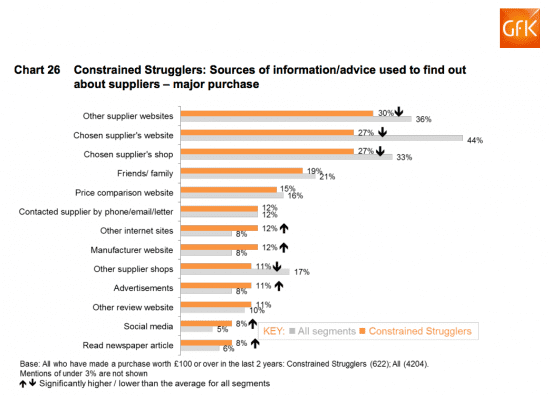

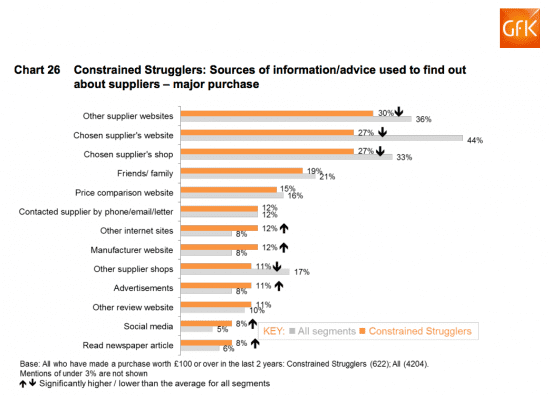

Where do they find information to help their purchase?

When purchasing an item worth over £100, the respondents were asked questions around choice, sources for research, motivations and if they were involved in negotiating. The 'Constrained Strugglers' as expected used a narrow choice of suppliers on average compared to the rest of the respondents, and are less inclined to research on-line. So this tells us that they are least engaged so don't' spend time attracting them with online reviews and offers, and your SEO needs to be good for them to find you quickly. They will look for information in newspapers and across social media so establish a presence here if they are your target group.

You can download the full 'Consumer Empowerment Survey Report'.