A guide to process, tools and examples for social media listening

What I’ve leant from social media listening

Two recent reports highlight the fact the business are not taking social media listening seriously and it’s still in its infancy. A study by the Altimeter group showed that only 42% of businesses are using social media listening to learn from their customers, this was a study whose respondents’ main discipline was social media, personally I would have expected it to be higher.

The second report from Amiando (a study of event marketers) showed that only 20% of marketers are listening in social for the benefit of the business.

I know I’m a big social media advocate, but I’m shocked that businesses are not using listening not only to benefit social media activity but the overall business, I guess it’s not been 'sold' in to the powers that be yet.

In this article, I hope to explain how to implement social media. Where possible I will mention brands in the examples, in other places I will need to be a little more respectful of the brand’s privacy. It’s also worth noting that some of this was done purely as an experiment without the brand’s permission as part of exercise, which just goes to show how much information you can garner on other brands without the need for permission.

Drivers for examining social data.

'Your brand is what people say about you when you’re not in the room' Jeff Bezos, Founder of Amazon. With social they know you’re in the room and they still tend to say it.

I would argue that in focus groups or using surveys people tend to answer the questions in a way that they wish to be portrayed by their peers. While this may also be said for social (personal branding), the very nature of focus groups and surveys gives users the chance to reflect before saying anything. Social media has a cultural immediacy where users express their opinions en mass and are not prompted by questions that steer answers.

New Insights - drivers for examining social data

There are many drivers for examining social data, which can all be broadly put under 'New insights'. Insights should be driving:

- Targeted marketing activity: Informing messaging, demographics, personas, influencers, firmographics, segmentation and comms strategy.

- Better planning and decision making within the business: Informing product and service development, market positioning to drive competitive advantage, growth hacking and business processes.

The customer decision process has fundamentally changed. A study by McKinsey showed that rather than systematically narrowing their choices, consumers add and subtract brands from a group under consideration during an extended evaluation phase.

By examining data we can derive maximum value from our customers by truly understanding their needs throughout the buying process and delivering to these needs, allowing our customer to get the maximum value from us. After purchase, they often enter into an open-ended relationship with the brand, sharing their experience with it online.

Data should be at the heart of our business decisions: Being a creative guy at heart I still find it hard to swallow … but it’s true, data should be part of the process when informing our creativity

The framework below is something I use regularly to explain the different aspects of Social Media and how they fit together, it shows that listening is at the heart, understanding audiences and competitors in the social space is key. As already mentioned listening can inform a more that just social media, you could easily include additional activities such as New product Development, Business processes, Campaign activity. What else would you add here outside of the social media remit?

How social media listening works

- Billions of conversations occur over multiple social networks every day.

- All public social data is aggregated via big social data aggregators such as GNIP, Topsy and Data Sift.

- Listening and analytics platforms such as Radian6, AdobeSocial, UberVu, SocialBakers use keywords to begin to structure the unstructured social data using smart algorithms. For selecting the best tool for your business, see this articles on criteria to compare social listening tools.

- So far all the above has happened with little intervention (really just inputting keywords into the listening tool), from this you must define your listening programmes to derive insight. While the listening platforms will do a job of collating and organising the data it’s not until you start manually interrogating the data will you begin to truly understand what’s presented in front of you.

The process of social media listening

- Whichever listening platform you decide to go with, your first port of call will be telling the platform what to listen for. An initial set of keywords could be generated around a product, service, brand mentions, industry events, or competition mentions.

- Once you have set your keywords you will probably need to refine them after 24 hours to see if you need to filter out any terms that may not be relevant, for example entering in some keywords around the sport 'Golf' you may need to filter out terms such as 'Car', 'VW', 'Volkswagen' to ensure you not capturing mentions about the car manufacturer, this will normally appear in most platforms under a field that says something like 'Do not include these terms'.

- Once you have refined your keywords you can begin to mine the data for common conversations, identify influencers, detractors and communities, and begin the process of segmentation.

- Once have your insights from social media it’s good practice to see if you can find other sources to either prove or disprove your insights and a way to hopefully strengthen your position to the business such as audience survey and research reports.

Once you have delivered your first set of insights you may feel the need to refine your keywords making new discoveries or honing you initial set of findings.

A word on sentiment tracking, I don’t care what % of accuracy a platform claims to have based on their "advanced algorithms", the best way to understand sentiment is to manually interrogate the data. This takes time and effort.

Types of social media listening

The type of listening program you employ should be based on what you’re trying to achieve and the insights needed to help answer your business or marketing objectives. Below are just some types of listening you may wish to undergo.

- New Product development or campaign tracking

- Sentiment tracking and breakdowns

- Alerts and news jacking

- Influencer and detractor mapping

- Audience and competitor deep dives

- Social Optimisation.

What should you be listening for

Which very much depends on what you are trying to achieve

- Demographics (and firmographics): While you may feel you have a good understanding of who you are trying to reach, social media listening can uncover new segments to target and also help you understand the level of importance each segment should hold for the business.

- Where: Not just the social platforms that your audiences regularly use, but the blogs they read and the forums and groups they engage with. Where can also lead to the geography of your audience base, if you are looking at multi-lingual activity, where best to start.

- When: When is the best time to engage with your audience, when will you get better levels of awareness, engagement and response.

- Competition: Across some selected keywords measure the share of voice against key competitors to understand how effective your social activity has been. Also to understand their Tone of Voice (TOV), the content they produce and themes.

- What: What is already working with your target audience? What do they seem to be receptive to? What are they talking about?

- Attitudes: Include Triggers in the buying process, pain points the audience may have that you could solve, hot topics they are discussing which you could piggy back or have an opinion on and finally sentiment, how happy, upset or neutral commentary is. For me this is where you can begin to drive some of the biggest insights that will help inform a multitude of strategy, tactics and actions.

Some examples of social media listening

The following show some listening and research programs and what they have helped to define. Remember I mentioned we need to start with an objective in mind so for the next few examples I will show the objective, insight and what that then went onto inform.

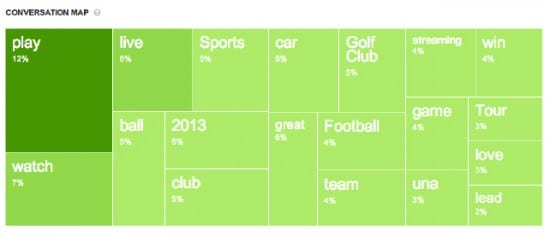

Golf Brand - Informing engagement strategy

Objective: To improve levels of engagement across social channels for a golf brand.

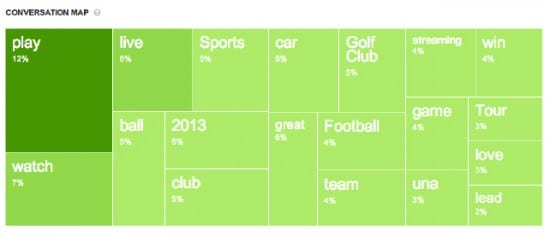

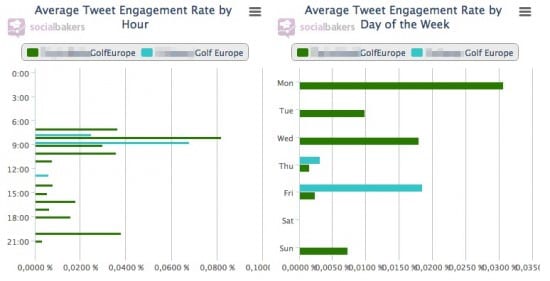

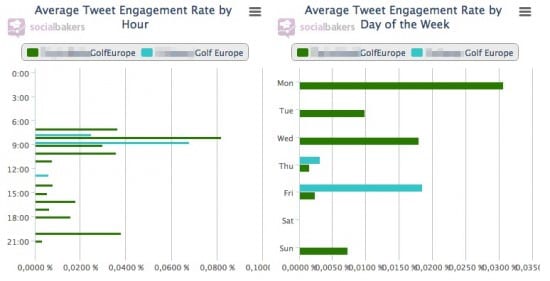

Listening Tasks: Looking at a conversation maps we begin to understand audience conversations, around the topic of golf. Looking at when golfers are most engaged across social channels, we understand when best to publish content and speak to golfers.

Insights: Conversation map showed that actually golfers tend to discuss the pro tours first, then their game then the products they use. The brand in question spent most of its time talking about the products they sold rather that what really interested golfers. The brand needed to flip their content strategy on its head, tour news, playing the game and then their products.

Looking at competitors it was clear that engagement was a bit of an after thought for the brand, only engaging towards the end of the week, when the competition saw great levels of engagement at the start of the week.

It was concluded, that people would mainly play golf on the weekends and their first chance to chat about their game would on the Monday either just before or just after they got to the office, also this matched generally with how the pro tours operate (over the weekends). There was a need to ensure staff within the business were listening to conversations and engaging on a Monday morning.

Campaign Example: New product Development

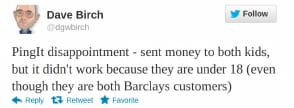

Objective: Understand what quick improvements can be made following the launch of the Barclays PingIt App.

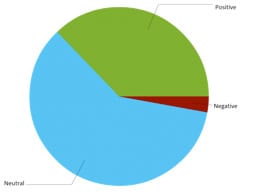

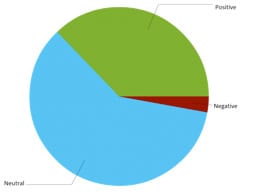

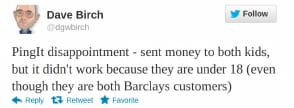

Listening task: Manually understand sentiment (which was predominately neutral or positive). Then look through the negative sentiment to identify opportunities to improve the PintIt App.

Insights: It was clear after looking through the negative sentiment that parents were unhappy that they could not send their children funds because they were under 18, even though they were Barclays customers. Within a week Barclays updated the product giving 16 and 17 year olds access to the app.

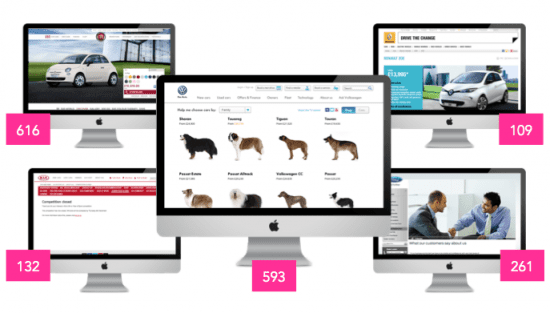

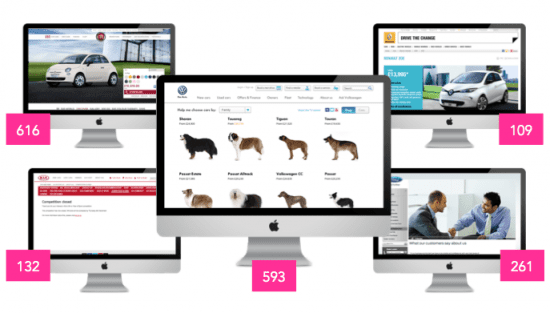

Campaign - Automotive Brand - Looking at the competition, informing on-site content

To begin to understand what on-site content resonates with key automotive target audiences we looked at the 5 other automotive brands to discover work worked best. We looked at the page after the homepage as this tended to be the most shared page of every site we looked at.

During the time period we found that the Fiat500 had the most amount of shares, but what interested us the most is that the VW dogs page had more shares (essentially you either owned a dog or liked a dog that helps you choose the car). Quirky slightly outside the box thinking that clearly got audiences engaged with the brand. This now gave our creative team’s the task to look at what we could do on site that was a little less obvious than the norm, for an upcoming product launch.

Which TV service would you go with?

As part of my presentation at Technology for Marketing and Advertising, I decided to take it upon myself to see if the crowd could make a decision about which TV service they would go with (regardless if they had already signed up to Sky or Virgin Media) based on social media listening alone. Disclosure: I did not deep dive into the data as I normally would, I am a Virgin Media customer (TiVo), neither Virgin Media or Sky are clients.

Why not try it yourself, from my findings which would you go with – add your choice in the comments.

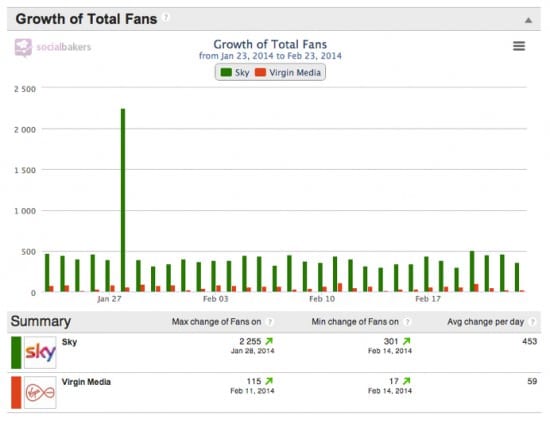

Sky vs Virgin

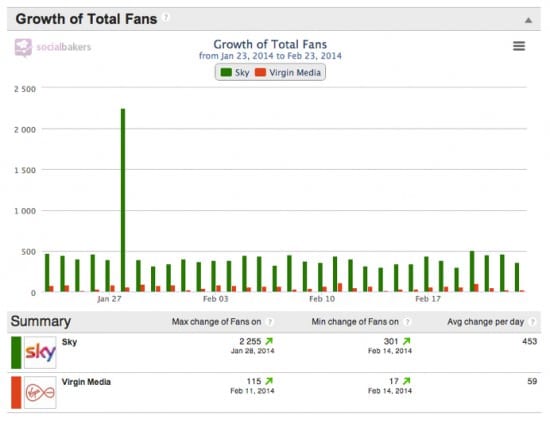

First off, fan growth, I would be surprised if Sky are not paying for their likes (through Facebook advertising) with an average of 450+ fans per day, and are receiving high levels of following by using competitions.

Question. Why isn’t Virgin achieving the same fan growth? More on this as we delve a little deeper.

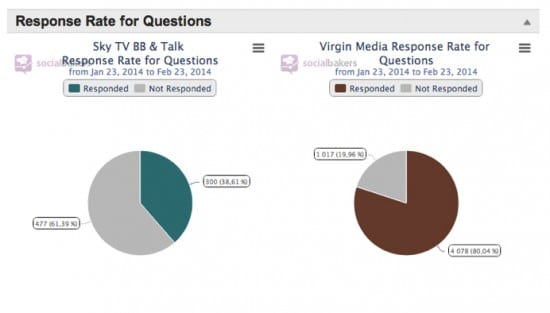

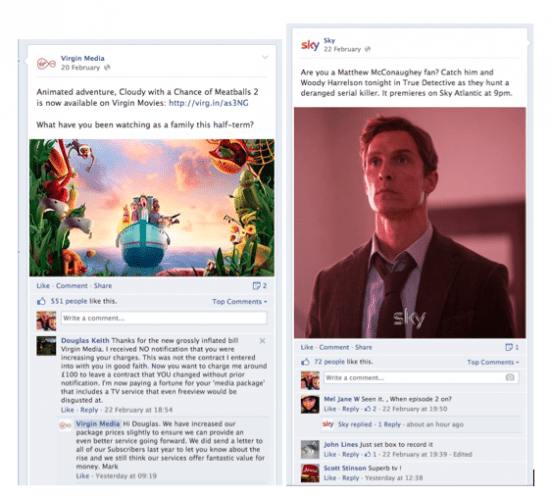

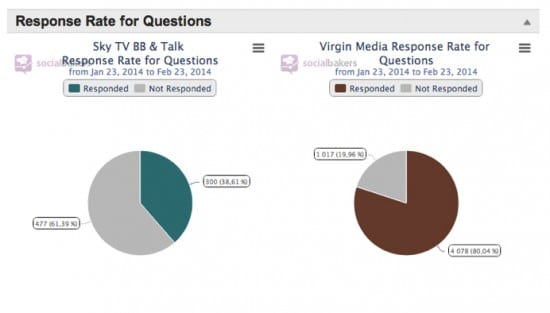

Virgin Media appear to have a huge level of engagement and are doing a much better job of responding to their fans.

Next Question. Why do Virgin media fans seem so much more engaged that Sky fans?

Though it is great to see a brand responding to their fans (4000+ Responses in one month = 133 responses a day or 16 responses an hour (8 hour working day)). Perhaps not leaving much time to produce content.

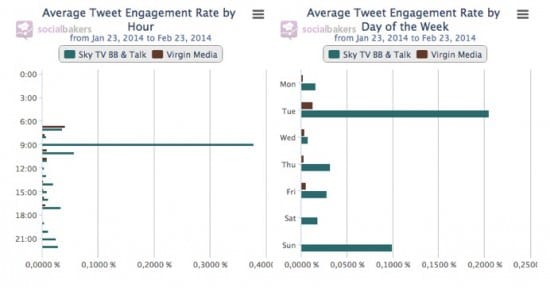

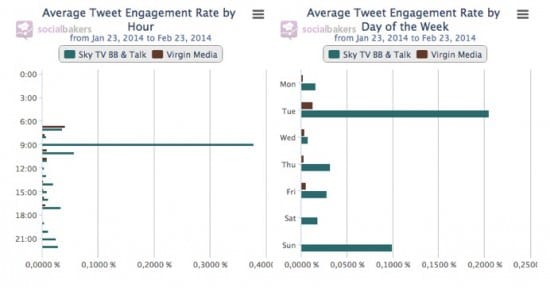

- When to talk to these brands

Looking at Twitter engagement would suggest that Sky are available to customers over the weekend which in our busy lives is about the only time we are free to talk to brands like this about issues we may be having with their service.

The reasons unfold

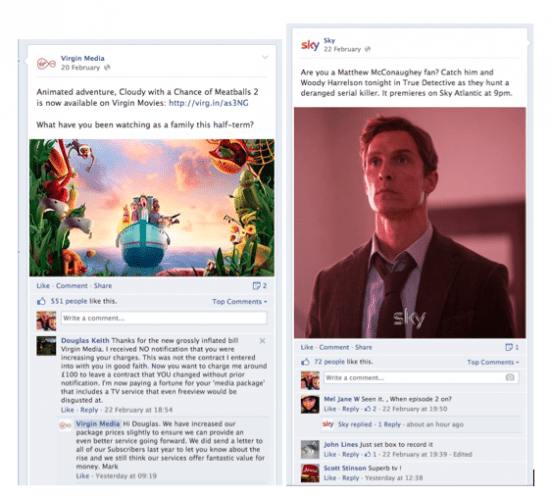

This was just one example I found in both Facebook pages, it’s clear that while people on Sky’s Facebook page are making comments about the programming, people on Virgin Media’s Facebook Page are complaining about their bills and the service.

So one conclusion (not necessarily the right one) could be that Virgin aren’t pushing fan growth because they feel that will just mean more complaints they need to deal with and perhaps this is also the same reason they are not creating campaigns or competitions that will drive more engagement.

It gets worse

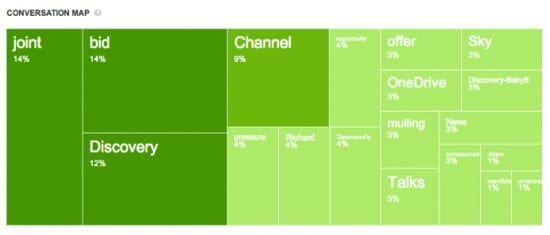

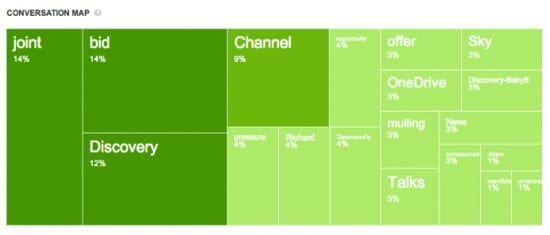

When you look at the conversations around the brand mentions (this was just a week’s worth of mentions from each brand taken at the same time).

Sky would seem to be in conversations with the Discovery channel to buy Channel 5, they are also in a legal battle over the term Sky Drive (One Drive) nothing massive to report there, at least from a consumer point of view. But then you look at Virgin Media results, they tell a pretty bad story, and I not sure it matters what order you put the terms, brewery, piss, botched, lie and Arrrrrrrggggg, it’s not a good sign.

Seek proof in other places

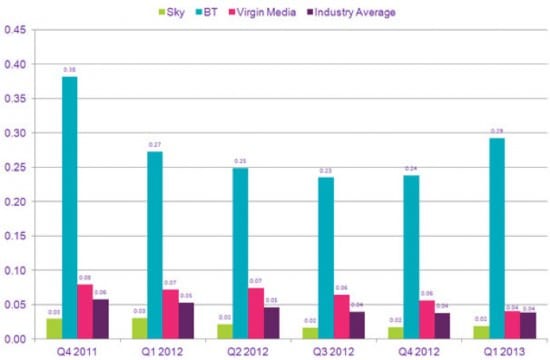

Social data is not the be all and end all, the more data points you can find and layer with existing social data will help you either prove or disprove your hypotheses. In this case a report from Ofcom suggests that Sky is by far the more popular than Virgin Media, with sky having over 3 times as many customers.

Sky Customers: 10,333,000 - Sky Q3 2012

Virgin Customers: 3,795,500 - Virgin Q4 2012

Ofcom

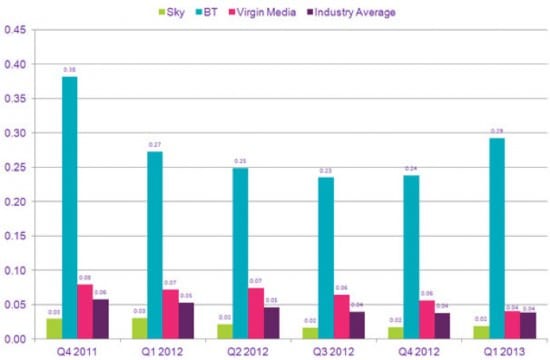

But then Sky is much more accessible as it’s really just a matter of fitting a dish to your house with no need to dig up road to fit cabling. So perhaps this does not help our story. But another report from Ofcom certainly backs some of the results we’re seeing in social channels.

Virgin Media’s complaints were slightly over the industry average at 0.04 per 1,000 customers, while Sky had the lowest number of complaints – 0.02 per 1,000 customers. October 2011 – March 2013

So from all this information whom would you choose? I now hope this is a rhetorical question, but would love to hear your opinion, if you’re with Virgin would this make you move or are you happy enough with your service? Also please share any social media listening stories you have.

Thanks to Joe Edwards for sharing his thoughts and opinions in this blog post. Over the years Joe has worked both client side and agency, working with Startups to Large Enterprise organisations in both B2B and B2C environments. He has worked with such organisations as Toyota, Adobe, Citi Bank, RBS, Visa, HP, Symantec, TfL, Studio Canal & eOne Entertainment to across Digital, Social and Mobile marketing disciplines. He is also part of The Institute of Direct and Digital Marketing (IDM) Marketing Advisory Council and delivers training on behalf of theIDM. Joe now works as Digital and Social Director for

MOI a global integrated marketing agency. You can find him on most social networks and connect with him on twitter

@brandjoe,

Linkedin or

Google+

Thanks to Joe Edwards for sharing his thoughts and opinions in this blog post. Over the years Joe has worked both client side and agency, working with Startups to Large Enterprise organisations in both B2B and B2C environments. He has worked with such organisations as Toyota, Adobe, Citi Bank, RBS, Visa, HP, Symantec, TfL, Studio Canal & eOne Entertainment to across Digital, Social and Mobile marketing disciplines. He is also part of The Institute of Direct and Digital Marketing (IDM) Marketing Advisory Council and delivers training on behalf of theIDM. Joe now works as Digital and Social Director for

Thanks to Joe Edwards for sharing his thoughts and opinions in this blog post. Over the years Joe has worked both client side and agency, working with Startups to Large Enterprise organisations in both B2B and B2C environments. He has worked with such organisations as Toyota, Adobe, Citi Bank, RBS, Visa, HP, Symantec, TfL, Studio Canal & eOne Entertainment to across Digital, Social and Mobile marketing disciplines. He is also part of The Institute of Direct and Digital Marketing (IDM) Marketing Advisory Council and delivers training on behalf of theIDM. Joe now works as Digital and Social Director for