What to avoid when looking for Ecommerce payment solutions

For most ecommerce retailers, payment gateways are seen as a necessary evil. Yes, they help you accept payments from your customers, but they’re not at the top of your list of organizations you like working with. They’ve developed a reputation of being sleazy, money-grubbing middlemen that take advantage of retailers, both big and small.

Some modern payment gateways, like Stripe, Braintree, and Sezzle, are finding ways to create more value for retailers and they’ve developed good reputations because of that. But problems remain. And if payment gateways want to shake their negative image within the e-commerce community, these are the five things they should focus on improving first.

1. They’re too expensive.

Payment gateways have long been rebuked by retailers for their high processing costs. The average rate today is 2.9% + 30c per transaction for online, or card-not-present, transactions. These costs have slowly increased for retailers, while the underlying cost and risk associated with processing these payments have decreased for gateways. How does that make any sense?

To put this in perspective, Europe recently passed legislation capping the interchange fees on credit and debit cards to the point where these fees are now 2-3 times higher in the US than they are in most European countries. Yet, payment gateways and issuing banks are still making enough money to continue operating profitably in Europe. Hmm.

2. They like to keep their fee structure hidden.

Payment gateways and processors have long played the hidden fee game. This is one area in which modern gateways like Stripe and Sezzle have made progress, by using simple, blended pricing models, but big problems still remain.

Merchant processing fees generally fall into one of two categories: (1) wholesale fees, and (2) markups. Wholesale fees are the interchange rates set by issuing banks and credit card companies. They are consistent regardless of which gateway you choose, so don’t waste your time trying to shop around for lower interchange rates. Markup fees are how your processor and/or gateway make a profit from your business. With the right gateway, these fees will be modest, but with the wrong gateway, you’re in big trouble. Some gateways make it as difficult as possible to know how much markup you’re paying by using bewildering terms and pricing models that would baffle even the most experienced business owner or retailer. Just a few examples include PCI fees, early termination fees, monthly minimum fees, statement fees, IRS report fees, and batch fees.

If you’re a large enough retailer, finding an interchange plus pricing model is usually the most transparent and cost-effective. Tiered pricing is traditionally the murkiest, including the most hidden fees. The newer gateways are using a blended model that keeps pricing simple, but costs tend to be higher for high-volume businesses, especially on debit transactions.

3. They haven’t figured out mobile yet.

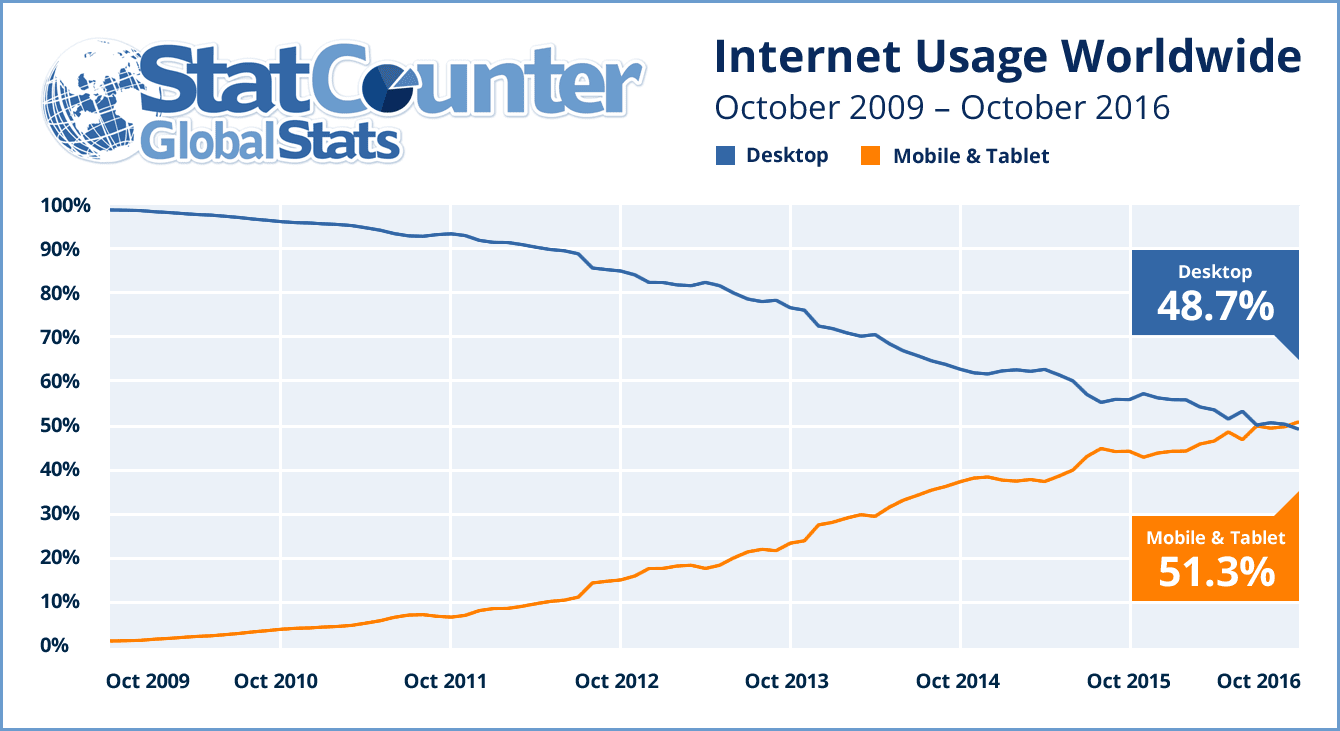

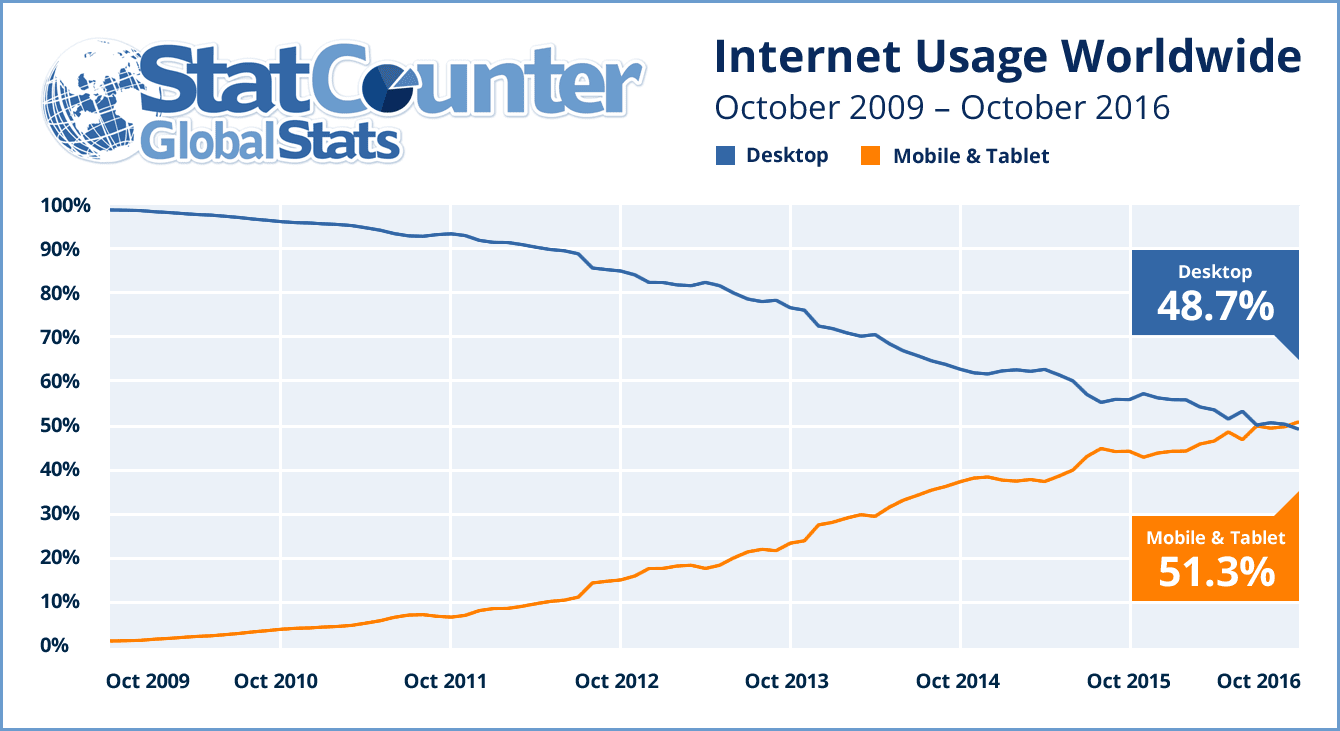

StatCounter reported earlier this month that in October more users around the world accessed the internet from mobile devices than from desktop computers, the first time in history that has occurred.

In addition, a recent Business Insider Intelligence report stated that by 2020, mobile commerce will make up 45% of total e-commerce. Personally, I think that will occur sooner than 2020, but you get the point. More and more people are using their mobile devices to access the internet, and to shop online.

Most ecommerce payment gateways, however, were developed to accommodate a payment network built on physical cards. At their core, cards are not mobile-friendly. They consist of multiple bits of numerical data that are difficult to memorize, and people are increasingly leaving their wallets and purses behind in favor of mobile phones.

Some gateways, like Apple Pay and Sezzle, have leveraged new technology to enable biometric and two-factor authentication for online payments. These technologies are much more mobile-friendly, requiring fingerprints, eye scans, or short PINs and texts to complete transactions. Let’s hope the trend continues.

4. They treat merchants unfairly on disputes and chargebacks.

Overall, chargebacks and fraud account for less than 1% of all transactions globally. However, the rate is higher for e-commerce transactions, and it’s growing. A typical e-commerce business offering physical products should see a 0.10% - 0.30% chargeback ratio, and a little over half of those will be for fraud. If you sell a non-physical product online, you’re likely to see a little higher ratio. And if you’re offering a subscription service, it will be higher still.

Chargeback fraud, also known as friendly fraud, is also a major problem for e-commerce retailers. This occurs when a consumer makes an online purchase, and then requests a chargeback from their issuing bank after receiving the purchased goods or services.

When a chargeback is approved, the merchant is accountable, regardless of the measures they took to verify the transaction. To add insult to injury, gateways will charge merchants a penalty when a chargeback occurs, because of the cost and risk to their own businesses (gateways can be shut down if their chargeback rates get too high).

Make sure you read the fine print in your gateway contracts, to better understand what the chargeback process looks like and how much you are penalized when a chargeback occurs. As a general rule, credit cards are most favorable to consumers when they request a chargeback, debit cards are in the middle, and bank payments are most favorable to merchants.

5. They haven’t figured out recurring payments yet.

A major shift is taking place in our economy, from a pay-per-product model to a subscription-based model. While recurring revenue provides businesses more steady cash flows, it requires companies to better manage a direct, complex, responsive, multi-channel relationship with its customers. Customers are absolutely key in this relationship, and rather than putting the focus of the business on the “product” or the “transaction,” subscription economy companies live and die by their ability to monetize long-term relationships rather than shipping products.

This poses a major challenge to payment gateways as well. Subscription-based companies typically see between 15-20% of recurring payments fail due to expired or canceled credit and debit cards. This is known in the business as “incidental churn.” Companies like Recurly have sprouted up to help businesses combat churn, but the fact is, cards are not an optimal payment method for recurring payments. An interesting solution some gateways are employing, including Sezzle and PayPal, is to enable customers to pay businesses directly from their bank accounts, which significantly reduces churn due to the fact that most people rarely change checking accounts. Many gateways are still behind the times, though, and for the subscription economy to continue growing, recurring payments must get better.

I would love to get your thoughts on these problems, and any more that I may have missed. Please reply in the comment section below. Thanks!

Thanks to

Paul Paradis for sharing his advice and opinions in this post. Paul is Chief Business Development Officer of

Sezzle You can follow him on

Twitter or connect on

LinkedIn.

Thanks to

Thanks to